Award winning, unique & innovative order flow and trade execution platform.

Platform Overview & Compatibility

Built around proprietary trading techniques that institutional traders use every day, daytradr’s tools are lightning fast and supremely effective. A platform built around gaining a true edge in the markets, trading data is presented exactly as you need it with no gimmicks. Able to accurately highlight events such as trapped traders, yet able to run ‘out of the box’. After all, if software is smart enough to help improve your edge in the market, it should NOT make you responsible for tuning 100’s of settings.

The software runs on Windows or on Mac with Bootcamp/Parallels emulators. There are 2 different versions of the tools.

daytradr Trading Platform™

Designed specifically for day traders of futures and exchange traded spreads, the daytradr platform is a robust stand-alone multi-threaded trading platform that connects to CQG, Rithmic, GAIN and IQFeed. daytradr contains all the features from the popular plug-in from Jigsaw (used by over 4,500 traders) and much more, to deliver a truly flawless trading experience.

Note that the GAIN Feed is also known by the following names: Alpha Trader, Apex Trader, ATC Trader, CTG Pro, DT Pro, G-Force Trader, Global Zen Trader, High Ground Trader, Index Trade Launcher, S5 Trader & Zaner 360.

Jigsaw Bridge™/Plug-in

The award winning tools integrate to your existing trading platform. Platforms supported include MultiCharts.NET, MultiCharts.NET SE, NinjaTrader 7/8 and Tradovate.

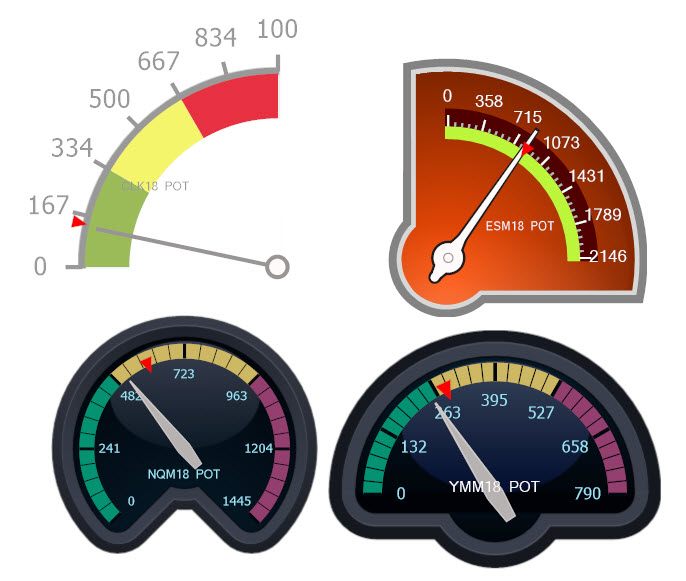

Smart Gauges

The Pace of Tape Smart Gauge comes in over 50 of styles and gives you an easy to absorb view of the pace of trading in a market relative to recent historical average.

The most obvious use of this is to see the change in trading activity at key inflection points (e.g. support & resistance levels) in the market. Less obvious uses are in helping to gauge the strength of a pullback, the chances of a market breaking out and in trade management. These are all uses of the pace of trade used by institutional day traders every day.

A slightly different use but equally beneficial is monitoring the pace of correlated markets. For example, if S&P, Nasdaq and DOW Futures are all lively – you have more chance of follow through. If only your market is lively but the other 2 quiet, it’s more likely any move will soon fade.

In addition to this, we also have meters for:

- Market Depth

- Order Book pulling/Stacking

- Trades (all trades, trades since opening a position, trades in past n seconds, filtered trades)

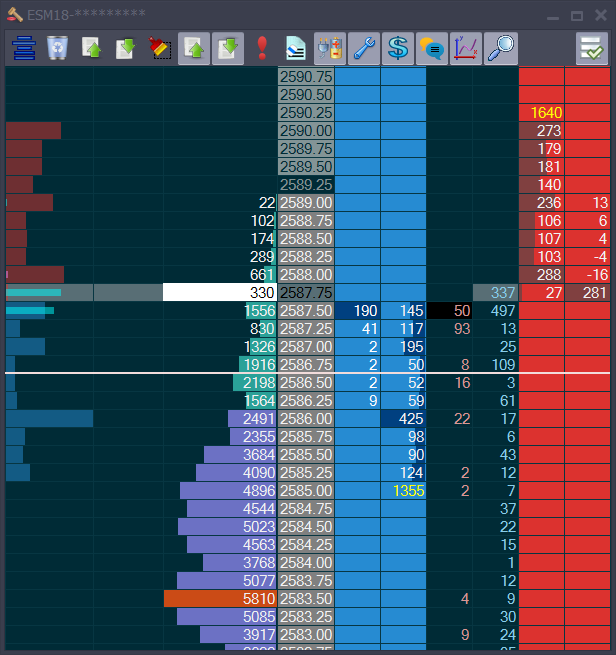

Depth & Sales (Depth of Market)

The Depth & Sales is Jigsaw’s interpretation of the Depth of Market (DOM). A tool that is the cornerstone of the proprietary trader’s decision making process. It is here we see the interaction between passive traders (limit orders) and active traders (market orders). This is where we get a visceral feel for trading activity. Regardless of how you will make decisions longer term (via the DOM or our more visual tools), spending time doing drills on our DOM will pay off huge dividends in terms of your market understanding.

The Depth & Sales shows:

- The impact of trades hitting the market

- Where traders are getting stuck

- Likely location of stop orders/where traders are positioned

- Where traders are pulling(cancelling) their orders, to avoid a move

- Where traders are stacking (iceberging) and front-running the market in anticipation of the market holding

- Balance of trade/momentum

- Alert column for pre-market notes

- Integration to JS Services Desktop

- Order Queue Position

- Trade P&L Per Price

The Depth & Sales is also your primary order entry tool, with one click trading, automated exit strategies, auto order types, volume based stops, and the overall feel of an execution tool that could only have been developed by a fellow trader.

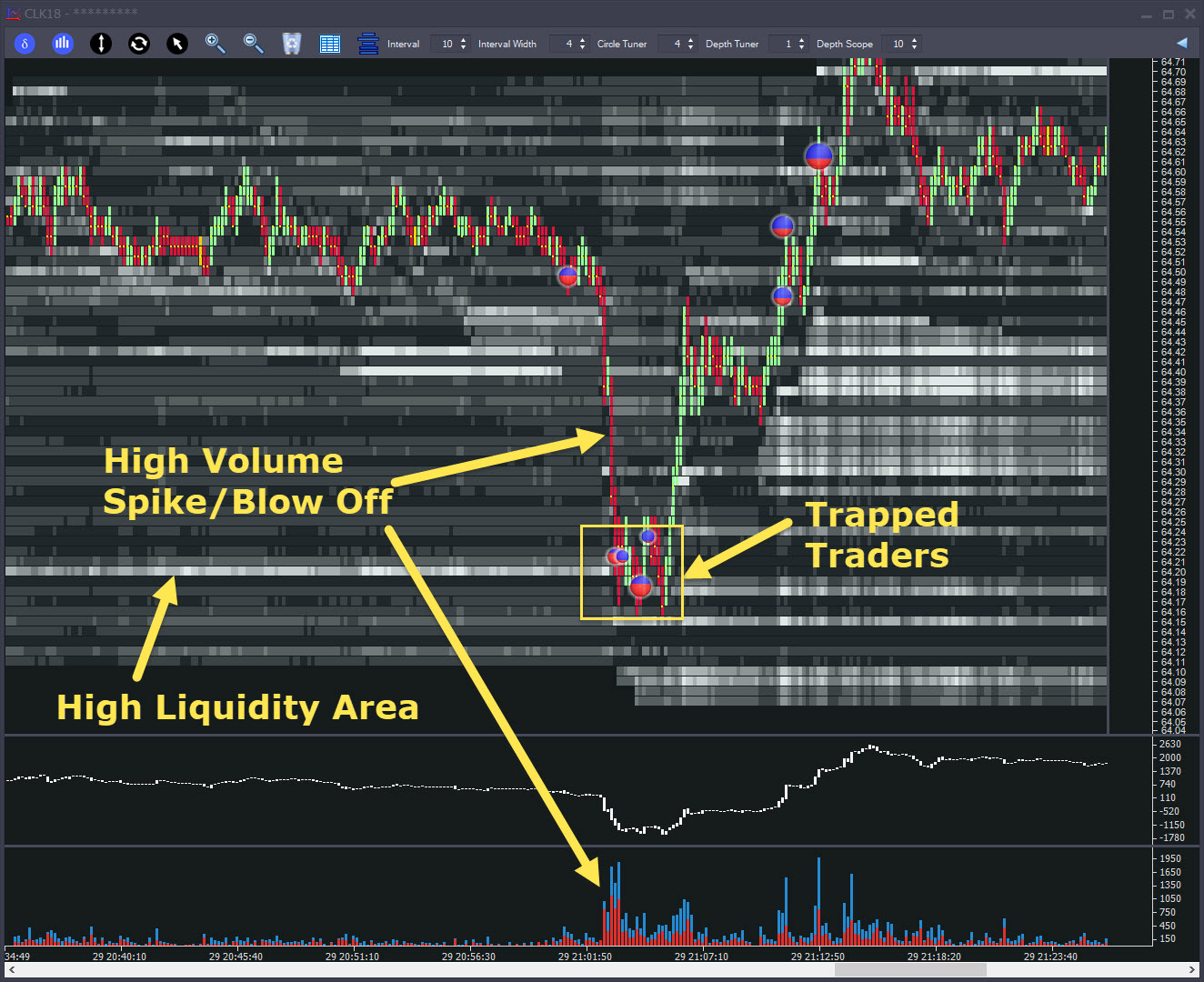

Auction Vista – Order Flow History

Auction Vista gives a detailed view of both real time and historical order flow. An extremely accurate ‘self tuning’ view with very few settings required to get the most from it.

- Market Depth visualization – the shaded background contains lighter areas show us where liquidity exists. This is not a guarantee of the market holding but a heads up that other traders are interested in that area. As price approaches, we look for front running by other trader or for the liquidity to be pulled out of the way.

- Large Trade Circles – the platform’s proprietary algorithm, reveals areas of high volume that trade at a level over time. Time and time again, these circles pinpoint key areas such as the end of a volume blow off, iceberg orders and market turning points.

- Trade From Chart – Manage your trades directly from the chart.

- Price Delta Chart, Cumulative Delta, Volume Delta Bars, Depth Histogram and Flip Charts make this the most complete Order Flow chart on the market.

And Much More

There’s too many great features to list that aren’t on this page but for the really curious, you can take a look at the product manual.. Here’s a list of other things to look out for:

- Reconstructed Tape – Time & Sales on steroids!

- Order Flow Event Alerts (iceberg alert, block trade alert, large trade alert, divergence alert)

- Innovative workspace management

- Position and Orders analysis window – with direct trading interface

- Custom Trading Sessions

- Automatic Symbol Download

- Exchange Traded Spread Support

- Equity Support (NASDAQ L2)

- Global Market Support – e.g. US, Europe, Hong Kong, Sydney, Osaka (additional markets added on request)

Enhance Your Futures Trading Knowledge

Download Our Free eBooks

Need broker assistance or guidance on platform offerings?