As we enter into the 2020 New Year, GFF Brokers would like to take a moment to thank you for allowing us the opportunity to earn your business. We wish you a successful New Year!!!

Upcoming Government Reports & Holidays

| Jan 01 | NEW YEAR’S DAY |

| Jan 03 | CONSTRUCTION SPENDING REPORT |

| Jan 07 | US INTERNATIONAL TRADE IN GOODS & SERVICES REPORT |

| Jan 07 | MANUFACTURERS’ SHIPMENTS, INVENTORIES & ORDERS REPORT |

| Jan 10 | EMPLOYMENT SITUATION REPORT |

| Jan 10 | MONTHLY WHOLESALE TRADE: SALES & INVENTORIES REPORT |

| Jan 14 | CONSUMER PRICE INDEX REPORT |

| Jan 15 | PRODUCER PRICE INDEX REPORT |

| Jan 16 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD SERVICES REPORT |

| Jan 16 | MANUFACTURING AND TRADE: INVENTORIES & SALES REPORT |

| Jan 17 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| TBA | NEW RESIDENTIAL SALES REPORT |

| TBA | ADVANCE ECONOMIC INDICATORS REPORT |

| Jan 20 | MARTIN LUTHER KING DAY |

| Jan 30 | GROSS DOMESTIC PRODUCT ADVANCE ESTIMATE REPORT |

Key Events That Moved the Market in Dec. 2019

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

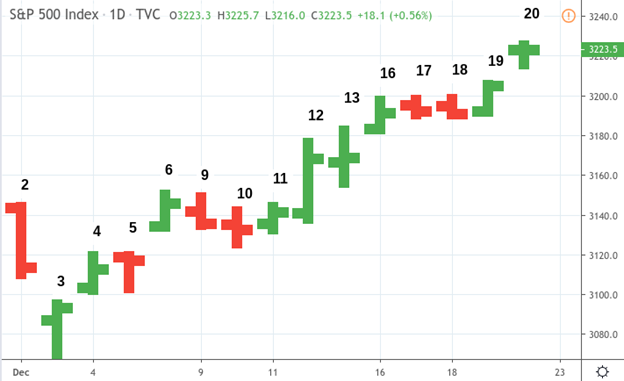

S&P 500 Index Daily Chart from December 1 to December 20, 2019

December 2

- Today saw a steep drop across all three major US indexes as trade news coupled with unfavorable manufacturing report dampened the optimism that fueled the broader market to new heights in November.

- It remains unclear as to when a phase one US-China trade deal might take place, particularly after President Trump had signed legislation in support of the Hong Kong protests. If a trade deal doesn’t take place before December 15, the possibility of additional US tariffs on Chinese goods may move ahead as scheduled.

- In addition to tariffs on China, President Trump also tweeted: Brazil and Argentina have been presiding over a massive devaluation of their currencies. which is not good for our farmers. Therefore, effective immediately, I will restore the Tariffs on all Steel & Aluminum that is shipped into the U.S. from those countries.

- Topping off doubts in the current trade environment, the ISM Manufacturing PMI came in at 48.1, showing us that manufacturing activity continued to contract last month. The ISM PMI figure is well below economist expectations of 49.4, and stocks seemed to have hit their lows upon the reports release.

- The question now is whether the data contain fundamental indications that may outweigh the factors that brought indexes to dazzling new heights last month, or whether this turn merely signals another short-term corrective phase.

- The Dow plunged 268.37 points, down -0.9%, closing at 27,783.04. The S&P 500 slid 0.9%, closing at 3,113.87 (note that today’s slide marks the S&Ps biggest down-day in two months. The Nasdaq closed at 8,567.99, down 1%. The VIX currently stands at 14.3, rising from its previous level of 12.6 at the start of the day.

December 3

- Stocks are on a three-day losing streak after President Trump said he might wait until after the 2020 presidential election before striking a trade deal with China.

- He said earlier today, I like the idea of waiting until after the election for the China deal, stating further that he has no deadline and that it is better to wait.

- Despite the markets recent negative performance, following a month of blistering gains, President Trump said that the decline is minor when compared to its cumulative performance since he took office.

- The now elusive phase one trade deal has been at the center of market sentiment and the overall headline volatility that has fueled the markets rise positive and negative fluctuations. As the US and China have implemented an escalating series of tariffs–the next round of tariffs on Chinese goods scheduled for December 15–markets have been looking forward to a phase one trade deal to help resolve at least this segment of economic and geopolitical uncertainty.

- Now investors are faced with the possibility that such an agreement may shift from vague to vanishing. The Dow plunged 280.23 points, giving back -1% to close at 27,502.81. The S&P 500 fell to 3,093.20, down -0.7%. The Nasdaq Composite ended the day at 8,520.64, down -0.6%.

December 4

- Not surprisingly, the broader market rebounded after its three-day slide on news that a US-China phase one trade deal is once again(drum roll please)…close to happening. The market response off these headlines have become at this point has become near-predictable. So much so that Neil Dwane of Allianz Global Investors in a CNBC report described investor sentiment has having a Pavlovian response (yes, he essentially equated the investing public to Pavlov’s dog…can you blame him?).

- One trade-related item that might have tempered the markets Pavlovian optimism was France and the EUs threat to retaliate should the US impose tariffs on French imports. This announcement came in response to a potential tariff list on French goods revealed Monday by a US trade official. That list, in turn, was in response to a new digital service tax which, according to Washington, places US tech companies in an unfavorable and less equitable position.

- In other economic news, the ADP employment report showed that private payrolls increased last month by 67,000, well below the 150,000 estimate.

- At closing, the Dow had gained 146.97 points, 0.5%, to end the day at 27,649.78. The S&P 500 rose slightly higher at 0.6%, ending the day at 3,112.76. The Nasdaq closed at 8,566.67, 0.5% higher.

December 5

- It was a choppy day of trading for the broader stock market, and the day ended with few changes to show for it. Let’s call it a day of pause. Today’s main market drivers were arguably yesterdays new on the US-China trade front and today’s unemployment report.

- To recap what had happened recently on the trade front, markets slid on Tuesday after Trump said that the US can wait until after the 2020 election to strike a trade deal. Apparently, investors didn’t like that comment. On the following day, a Bloomberg report said that both countries were, once again, getting close to an agreement, and that separately, President Trump mentioned that trade talks were moving forward very well. As you might guess, markets rallied.

- Bear in mind that both countries have 10 days to reach a deal before additional tariffs on Chinese goods are to be levied. The coming round would impose tariffs on up to $156 billion worth in Chinese goods.

- The second of today’s market drivers–the unemployment report–came in relatively favorably with jobless claims declining by 10,000 to 203,000 in the last week of November. This beat estimates of 215,000. With the unemployment rate at 3.6%–meaning its still at a 50-year low–it shows that despite the slight slowing in US economic growth, companies dont want to lay off its workers. This factor is arguably significant, as the low unemployment rate has played a critical role in driving the current economic expansion.

- The Dow advanced 0.1%, a mere 28 points to close at 27,677.79. The S&P 500 close higher at 3,117.43, gaining 0.16%. The Nasdaq trailed behind gaining less than 0.1%, ending the day at 8,570.70. All three indexes traded in a choppy manner, seeking direction as they straddled between gains and losses throughout most of the day.

December 6

- The broader stock market mounted an impressive surge on top of a better-than-expected jobs report that topped analyst expectations.

- 266,000 jobs were added in November, far above the 187,000 that economists had predicted. The unemployment rate, falling to 3.5%, remains at a 50-year low. In addition to this, the labor department also revised its September and October job figures upward–from 180,000 to 193,000 in September, and from 128,000 to 156,000 in October. Today’s data alongside past months revisions affirmed strength in this particular segment of the US economy.

- So what implications might these stellar figures have on the ongoing US-China trade talks? According to MarketWatch, some market experts believe it plays to the advantage of US negotiators–that it can embolden U.S. trade negotiators in a protracted tariff dispute between the U.S. and China possibly resulting in a delay if not outright scuttling of a long-sought-after resolution.

- The Dow surged 337.27 points to close 1.2% higher at 28,015.06. The S&P 500 gained 0.9% to close at 3,145.91. The Nasdaq closed at 8,656.53, advancing 1%.

December 9

- Stocks took a pause from last weeks sizable surge breaking a three-session winning streak as investors digest the implications of a limited US-China trade deal in light of Fridays jobs report and the looming December 15 deadline for the introduction of new tariffs on Chinese goods.

- 10 and 30-year US Treasury yields pulled back today as investors await the FOMC decision this Wednesday. The 10-year yield fell 1.3 basis points to 1.829%, the 30-year fell 2 points to 2.264%, while the 2-year rose 0.8 basis points to 1.627. Investors by and large are expecting the Federal Reserve to take no interest rate action by for the last meeting of 2019.

- In addition to the start of the FOMC meeting, tomorrows economic reports will include productivity and costs data. No major economic reports have been scheduled for today.

- The Dow closed lower at 27,909.60, down 105.46 points or -0.4%. The S&P 500 declined 0.3%, closing at 3,135.96. The Nasdaq Composite fell to 8,621.83, down 0.4%.

December 10

- Stocks today had a relatively volatile session but ended the day just slightly lower. It appears that the looming trade deadline may be a factor weighing on investor sentiment.

- A new round of tariffs are scheduled to hit Chinese imports on Sunday, December 15. In a report that some investors find slightly optimistic, the WSJ said that the tariffs may be delayed amid active negotiations between the US and China. According to the report, negotiators on the US side are asking China to commit to a certain amount of agricultural purchases. Chinese negotiators, however, want to see their purchases reciprocated in the form of tariff roll-backs.

- The news that US officials are reviewing this request may be what fueled the surge from today’s market lows. Apparently, that surge was short-lived.

- On the economic front, the non-farm productivity numbers came in at -0.2%, a slight decline from economist expectations of -0.1%. The FOMC meeting began today, and investors are awaiting tomorrows announcement in which they expect the rates to stay put.

- The Dow closed at 27,881.72, down 27.88 or 0.1%. The S&P 500 and Nasdaq also slid 0.1%, closing at 3,132.52 and 8,616.18 respectively.

December 11

- Mild advances across the board today as Fed Chair Jerome Powell assured investors that the central bank will not raise rates unless it sees a significant move in inflation. As expected, the Federal Reserve held rates steady, putting any policy changes on hold unless any major shift in economic outlook should take place.

- The Dow closed at 28,132.05. The S&P also advanced, closing at 3,128.57. The Nasdaq Composite ended the day at 8,717.31.

December 12

- The broader US market exhibited a tremendous follow-up surge in overnight trade arguably stemming from yesterday’s Fed “inaction” but more importantly, their message regarding monetary policy. Prices fell slightly when China announced that it will retaliate should President Trump move forward in levying additional tariffs on December 15. But later in the day, Wall Street seized on reports that a trade deal was near, sending indexes to record highs.

- The producer price index came in unchanged in November as economists expected an advance of 0.2% from October. Initial jobless claims increased 49,000 to 252,000 in the week ended December 7. Economists expected 212,000 new jobless claims.

- The Dow closed at 28,135.38, the S&P 500 ended at 3,168.80, while the Nasdaq climbed to 8,734.87.

December 13

- Markets continued their climb to even higher record-highs due to US-China trade deal optimism and UK PM Boris Johnson’s resounding election victory. The election results dramatically increased hopes for a quick exit from the European Union, sending U.K.’s FTSE 250 index touched a record high.

- S. retail sales in November increased 0.2%, much less than the forecasted 0.5% that analysts had anticipated in November. Prices for goods imported into the U.S. rose in November, up 0.2%, matching expectations.

- The Dow ended the day at 28,235.89, the S&P 500 closed at 3,191.45, and the Nasdaq Composite climbed to 8,814.22.

December 16

- The broader US stock market rose for a fourth straight day today as the so-called phase one trade deal between the US and China gave a reason for the markets to aim toward a banner end-of-year.

- Despite some details such as agricultural purchases remaining obscure, as well as the US trade deficit, US trade official Robert Lighthizer assured markets that the phase one deal is “totally done.”

- On the data front, the housing market index rose in December to a 20-year high. Business activity also rose, hitting a five-month high.

- The Dow jumped 100.51 points, or 0.4% to close at 28,235.89. The S&P 500 advanced 0.7%, closing at 3,191.45. The Nasdaq Composite gained 0.9%, to end the day at 8,814.23.

December 17

- New home construction increased in November, according to the Commerce Department. Housing starts rose by 3.2% i to a seasonally adjusted annual rate of 1.365 million. Economists forecasted a rise of 2.0% to an annual pace of 1.34 million.

- Residential permits advanced 1.4% from the previous month to a rate of 1.482 million. Economists expected them to decline by 3.5% to 1.410 million. Industrial production in November increased 1.1% when a gain of .9% was estimated and capacity utilization was 77.3%, which compares to the expected 77.4%.

- The Dow closed at 28,267.00, the S&P 500 ended at 3,222.00, and the Nasdaq finished at 8,71350, all three indexes up for the day

December 18

- Stock hit intraday highs but then reversed gains late in the day to end its six-day winning streak. There was very little in terms of major news or reports to affect the markets significantly. The Dow fell -0.1%, down 27.88 points to close at 28,239.28. The S&P 500 pulled back -0.04% to close at 3,191.14.

December 19

- Despite President Trump’s impeachment proceedings and mixed economic data, markets managed to advance, hitting all-time highs. The S&P topped 3,200 for the first time.

- Initial jobless claims fell 18,000 to 234,000 in the week ended December 14 . Economists expected 227,000 new jobless claims. The Philadelphia Fed’s manufacturing business outlook survey’s index of business activity fell to 0.3 in December from a reading of 10.4 in November. Economists anticipated the index would be 8.

- The Dow Jones Industrial Average shot up 137.68 points, or 0.5% to 28,376.96. The S&P 500 gained 0.5% to end the day at 3,205.37, marking its first close above 3,200. The Nasdaq Composite finished at 8,887.22, gaining 0.7%.