Upcoming Government Reports & Holidays

| Jul 01 | CONSTRUCTION SPENDING REPORT |

| Jul 02 | US INTERNATIONAL TRADE IN GOODS & SERVICES REPORT |

| Jul 02 | MANUFACTURERS’ SHIPMENTS, INVENTORIES & ORDERS REPORT |

| Jul 02 | EMPLOYMENT SITUATION REPORT |

| Jul 09 | MONTHLY WHOLESALE TRADE: SALES & INVENTORIES REPORT |

| Jul 10 | PRODUCER PRICE INDEX REPORT |

| Jul 14 | CONSUMER PRICE INDEX REPORT |

| Jul 15 | QUARTERLY – BUSINESS FORMATION STATISTICS |

| Jul 16 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD SERVICES REPORT |

| Jul 16 | MANUFACTURING AND TRADE: INVENTORIES & SALES REPORT |

| Jul 17 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| Jul 24 | NEW RESIDENTIAL SALES REPORT |

| Jul 27 | ADVANCE REPORT ON DURABLE GOODS – MANUF… |

| Jul 28 | QUARTERLY – HOUSING VACANCIES & HOME OWN… |

| Jul 29 | ADVANCE ECONOMIC INDICATORS REPORT |

Key Events That Moved the Market in June 2020

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

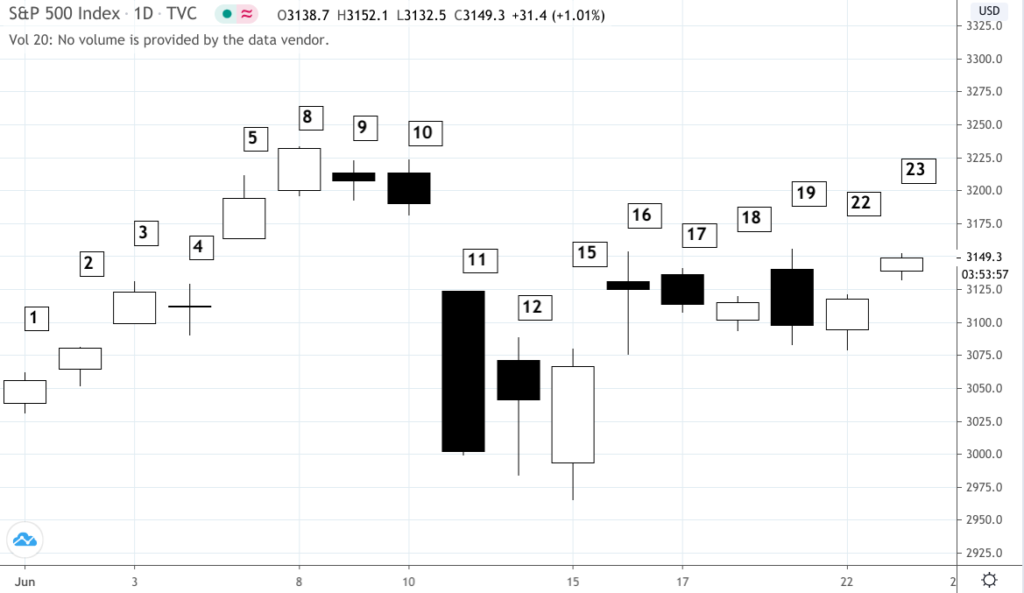

S&P 500 – Daily Chart – June 1 to 23, 2020 (Source: Tradingview)

June 1, 2020

- Last week’s gains led the broader market to its first back-to-back monthly gains since late 2019.

- The May PMI manufacturing Index came in at 39.8, in line with consensus.

- The May Institute for Supply Management manufacturing index came in at 43.1, above the anticipated 42.7.

- The April construction spending report came in at -2.9%, not as bad as the expected -5.5% decline.

June 2, 2020

- Markets rallied though there was no major economic news scheduled today.

June 3, 2020

- The S&P 500 advanced to its highest level since March 6 and the NASDAQ rose to its best levels since February 21.

- The S&P 500 is less than 10% off the record high that was hit in February and the NASDAQ isn’t far from historical highs either.

- Global equity markets are higher as hopes build for more economic stimulus.

- The Automatic Data Processing Inc. showed a decline of 2,760,000 when down 8,663,000 were expected. ADP said job losses likely peaked in April.

- Mortgage applications to purchase a home increased 5.0% for the week and were 18% higher than a year ago, according to the Mortgage Bankers Association.

June 4, 2020

- Stocks settled back, the broader market trading flat as it digests the latest jobless claims report.

- 1.87 million unemployed filed jobless claims, a figure that was slightly higher than the anticipated 1.79 million consensus.

- Investors may be waiting for Friday’s Employment Situation report to get a better grasp on the fundamental conditions that may lie ahead.

June 5, 2020 – Midday report

- The broader market staged an impressive rally as May saw the largest job gains of 2.5 million as the economy reopens.

- Nonfarm payrolls rose by 2.5 million in May, the unemployment rate falling to 13.3%.

- Economists were anticipating a decline of 8.3 million and a jobless level of 19.5%, which would have been near Great Depression era levels.

- Much of the gain came from workers who were experiencing temporary layoffs due to the COVID-19 lockdown.

- Leisure and hospitality represented almost half the jobs gained.

June 8, 2020

- US stock indexes advanced for a second day after the previous Froidya’s May U.S. employment numbers were released.

- Nonfarm payrolls increased 2,509,000 when economists anticipated a decline of 7,725,000.

- Today the S&P 500 futures to their highest level since February 26, while the NASDAQ traded at record highs.

June 9, 2020

- The Nasdaq continued its surge into record highs, though tepidly.

- The S&P 500, which is about 5% below its all-time high, erased its year-to-date losses.

- The National Federation of Independent Business small business optimism index was 94.4 for May, beating expectations of 92.

- The April Job Openings and Labor Turnover Survey (JOLTS) came in at 50.46 million, under the anticipated 5.75 million. The Labor Department’s JOLTS report tracks monthly changes in job openings and offers rates on hiring and quits.

June 10, 2020

- The Nasdaq advanced to a new record high of over 10,000.

- The S&P 500 and the Dow fell following the FOMC rate decision announcement.

- Federal Reserve Chair Jerome Powell mentioned in today’s FOMC meeting that no rate increases will be made through 2022.

- Applications for loans to purchase a home increased 5.0% last week from the previous week and were 13% higher than a year ago, according to the Mortgage Bankers Association.

- The May consumer price index was down 0.1% when unchanged was expected.

- The June Atlanta Federal Reserve business inflation expectations report will be released at 9:00 central time. The report last month showed inflation at 1.5%.

June 11, 2020

- Global markets declined after the Federal Reserve’s downbeat assessment of the near-term outlook for the U.S. economy.

- The Nasdaq pulled back from record highs.

- The Dow fell 1,800 points, its worst day since the March plunge.,

- The Federal Open Market Committee yesterday said it sees gross domestic product shrinking 6.5% in 2020 but bouncing back to a 5.0% gain in 2021 followed by a 3.5% advance in 2022, both are well above the economy’s longer-term trend.

- Jobless claims for last week came in at 1,542,000 when 1,565,000 were expected.

June 12, 2020 – Midday report

- Roller coaster ride today, with the Dow up 800 points, then down to only 100 and now up again 300 points.

- Mid-day, investors went right back into the plays whose fates hinge on a successful reopening of the economy.

- With three hours left in the trading day, the Dow is up 258.95 points, or +1.03%; the S&P 500 is up 19.84 points or +0.66%; and the Nasdaq is up 48.09, or +0.51%.

June 15, 2020

- US indices surged as investors jumped in to buy the deepest dip in stocks since the March crash.

- Markets initially tumbled as COVID-19 cases began surging across many US states as they began their reopening phases.

- The Empire State manufacturing survey showed the general business conditions index came in at -0.2, far better than the -30.0 that analysts were expecting.

June 16, 2020

- A roaring comeback in the market as retail sales came in at 17.7%, far above the consensus figure of 7.5%.

- This indicates that the economy’s recovery may have begun sooner than most states’ reopenings as consumer activity surged in the weeks prior.

- Markets have now recovered more than half of last week’s pullback.

- Housing markets were less affected in May than April, its index showing a seven-point gain over consensus at 58 instead of 44.

June 17, 2020

- The broader market slipped slightly today, taking a breather from its earlier rally.

- Homebuyer mortgage demand appeared to have increased to an 11-year high, as rates continue to fall, hitting another record low.

- Mortgage applications to purchase a home increased 4% last week from the prior week and were 21% higher than a year ago, according to the Mortgage Bankers Association. This was the ninth consecutive week of gains.

- May housing starts were 974,000, slightly under the 1,100,000 anticipated, and permits were 1,220,000, almost in line with consensus at 1,250,000.

June 18, 2020

- Jobless claims in the week ended June 13 came in at 1,508,000, slightly higher than the expected figure of 1,220,000.

- The June Philadelphia Federal Reserve business outlook survey was positive 27.5, beating expectations of -22.7.

- The broader market remained more or less unmoved.

June 19, 2020 – Midday report

- With almost no major economic releases today, surging COVID-19 cases remain in the news and stocks dipped into the red as Apple Inc announced it is re-closing stores in Arizona and Florida in response to the coronavirus infection surges.

- The Dow is down only -89.38 points (-0.34%), the S&P 500 slipped -7.65 points (-0.25%), and the Nasdaq is positive, gaining 3.69 points (+0.04)–all three indexes staging a strong recovery mid-day.

June 22, 2020

- US indexes advance due to central banks’ stimulus measures and investors’ optimism about the pace of the economic recovery.

- The May Chicago Federal Reserve national activity index was positive 2.61 when negative 4.0 was expected.

- The May home sales report came in at a dismal 3.910 million, far lower than the anticipated figure of 4.29 million.

June 23, 2020

- Indexes are higher with the NASDAQ hitting a record high.

- Much of the optimism is due to the tone of the U.S.-China trade situation.

- In addition, there is ongoing support from global central banks’ stimulus measures and investors’ optimism about the pace of the global economic recovery.

- May new home sales report came in at 676,000, surpassing expectations of 636,000.