It’s well known that billionaire investor and philanthropist George Soros has been a favorite scapegoat among right-wing conspiracy theorists for quite some time. He and his Open Society Foundation have been accused of many alleged left-wing “conspiratorial” acts.

Whether you agree with Soros’ left-leaning politics or not, one indisputable fact is that he is an incredibly brilliant investor and businessman.

Among several of his financial achievements and exploits, he is perhaps most known as “The Man Who Broke the Bank of England,” a moniker he can’t seem to live down.

And although this moniker can be taken in a negative or positive light, it tends to overshadow many of his other financial & philanthropic accomplishments.

But it does so for a reason: it was one of the biggest and boldest trades of the 20th century.

It all began in 1990, when Britain made a landmark decision to join the European Exchange Rate Mechanisms (ERM).

Based on the concept of having a “fixed” currency rate, an ERM links two or more currency exchange rates together, allowing each currency a limited degree of fluctuation between an upper and lower band.

By joining the European ERM, Britain was essentially linking the British pound to all other European currencies participating in the mechanism, in theory preventing wide currency fluctuations that may disrupt trade among European participants. Britain also wanted to keep its currency above 2.7 German marks to the pound.

As soon as Britain entered the ERM at the rate of 1 British pound to 2.95 German marks, Britain experienced an immediate fall in interest rates; London share prices surging in value.

But there was a glaring fundamental problem…

Unlike Germany, whose currency held the highest value among most ERM currencies save the pound, Britain’s inflation rate was three times higher than that of Germany’s. As compared with all other nations participating in the ERM, Germany’s inflation rate was quite low.

In other words, the pound’s high valuation in contrast to the mark was unsustainable given the fact that Britain’s inflation rate relative to Germany’s was too high. It was just a matter of time before the pound would fall toward its more realistic valuation. Soros saw an opportunity.

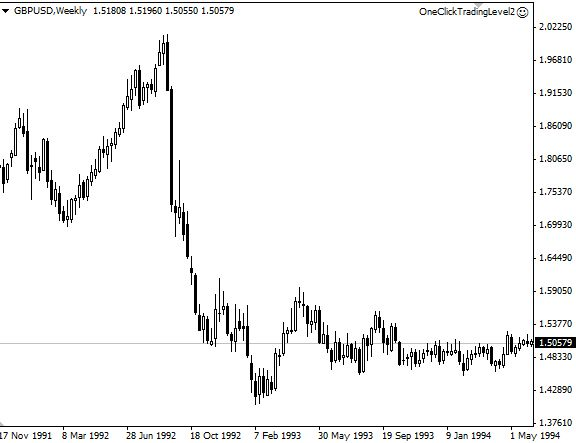

In the days leading up to September 16, 1992, Soros began shorting the British pound heavily.

Britain’s Treasury responded by buying the pound to support its price point at the upper ERM limit, above the Mark. Despite the British Treasury’s efforts, the pound began to fall.

The British government then resorted to a desperate move: they raised the pound’s interest rate as high as 15% to attract buyers and investors.

But that effort too did very little to ameliorate the situation…

In the month of September alone, the pound declined by 15%…and it kept on falling…all the way through December.

In the end, the Pound lost 25.4% of its value; it went from a September high of 2.01100 to a December low of 1.4935.

Meanwhile, George Soros exited the trade with a profit of $1 Billion, cementing his reputation as one of the greatest currency traders–or “raiders”–of all time: the man who broke the bank of England.

There is a substantial risk of loss in trading futures, options and forex. Past performance is not necessarily indicative of future results.