Upcoming Government Reports & Holidays

| Aug 03 | CONSTRUCTION SPENDING REPORT |

| Aug 04 | MANUFACTURERS’ SHIPMENTS, INVENTORIES & ORDERS REPORT |

| Aug 05 | US INTERNATIONAL TRADE IN GOODS & SERVICES REPORT |

| Aug 07 | MONTHLY WHOLESALE TRADE: SALES & INVENTORIES REPORT |

| Aug 07 | EMPLOYMENT SITUATION REPORT |

| Aug 11 | PRODUCER PRICE INDEX REPORT |

| Aug 12 | CONSUMER PRICE INDEX REPORT |

| Aug 14 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD SERVICES REPORT |

| Aug 14 | MANUFACTURING AND TRADE: INVENTORIES & SALES REPORT |

| Aug 18 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| Aug 19 | ADVANCE SERVICES REPORT |

| Aug 19 | QUARTERLY SERVICES SURVEY |

| Aug 25 | NEW RESIDENTIAL SALES REPORT |

| Aug 26 | ADVANCE REPORT ON DURABLE GOODS – MANUFACTURERS’ SHIPMENTS… |

| Aug 28 | ADVANCE ECONOMIC INDICATORS REPORT |

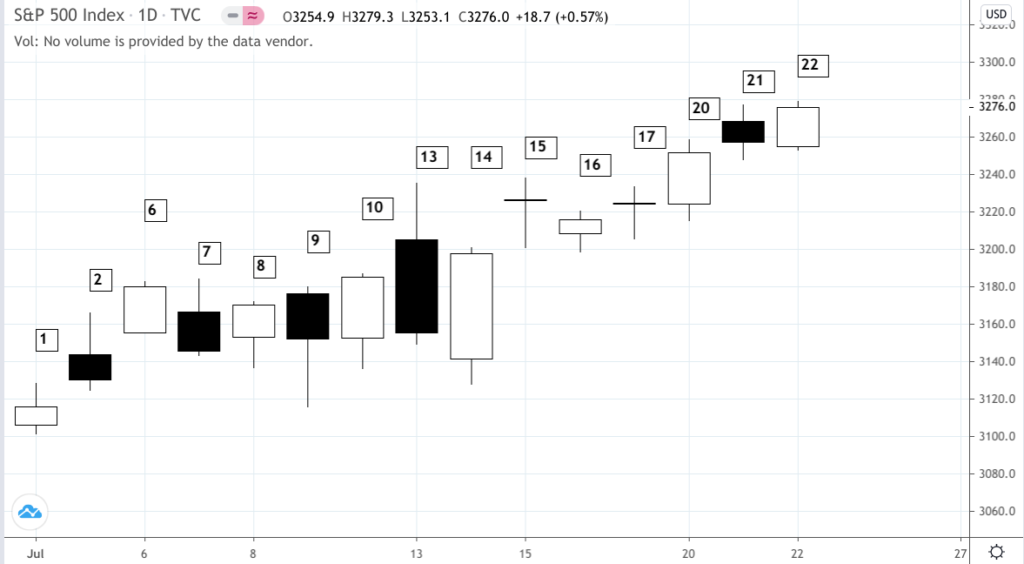

Key Events That Moved the Market in July 2020

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

S&P 500 – Daily Chart – July 1 to 22, 2020 (Source: Tradingview)

July 1, 2020

- Stocks ended June with its best quarter in over 20 years.

The ADP employment change report showed an increase of 2,369,000, slightly below expectations of 3,500,000. - The June PMI manufacturing index came in at 49.8 nearly in line with 49.6 consensus.

- The June ISM manufacturing index came in at 52.6, beating expectations of 49.

- May construction spending report show a decrease of -2.1% below expectations of an 0.8% increase.

July 2, 2020

- Stocks advanced with the Nasdaq Composite reaching a new record high on report of outstanding job growth numbers.

- June nonfarm payrolls increased 4,800,00 when a gain of 3,000,000 was expected.

- The unemployment rate was cut to 11.1%, below the anticipated 12.4%.

- Jobless claims in the week ended June 27 were 1,427,000 when 1,400,000 were predicted.

July 3, 2020

- Markets closed

July 6, 2020

- Markets opened sharply higher as the Nasdaq advanced toward a new record high.

- The June Institute for Supply Management non-manufacturing index came in at 57.1 , besting the 50.1 consensus.

- Stocks overall are outperforming or overperforming the news.

July 7, 2020

- Nasdaq futures hit a record high in overnight trade before declining during the market day as tech shares outperform.

- The Organization for Economic Cooperation and Development made downbeat predictions about unemployment rates in most of the world’s advanced economies, likely the reason for the market’s decline.

- The JOLTS report came in with a positive shocker, with 5.397 million job openings against expectations of 4.9 million openings.

July 8, 2020

- With very little news on the economic front, stocks found support as several Federal Reserve presidents hinted at more stimulus.

- The May consumer credit report shows a decline of -$18.2 billion, slightly higher than the -$18.3 billion consensus figure.

July 9, 2020

- Weekly jobless claims fell from their highs in April. Jobless claims in the week ended July 4 were 1,314,000, less than the 1,375,000 claims expected.

- The Fed balance sheet currently stands at $6.921 trillion.

- The May wholesale trade report came in as anticipated, a 1.2% decline.

- Markets are lower over concerns about the state of the global economy.

July 10, 2020

- Markets are up as attention shifts toward Q2 earnings season.

- The Producer Price Index, which was expected to rise 0.4%, actually showed a decline by -0.2%.

- Reporting mid-day, the Dow is up 282 points (+1.10%), the S&P 500 is up 22.46 points (+0.71), and the Nasdaq is up 26.77 points (+0.25%).

July 13, 2020

- U.S. stock indices start the day higher with the Nasdaq momentarily reaching a new record high.

- Investors are turning their attention to major U.S. companies reporting Q2 earnings this week.

- Major banks begin reporting tomorrow.

July 14, 2020

- Markets advanced as investors digested second-quarter results from the biggest banks.

- Bank earnings have come in mixed but overall better than expected as more recent pressure is linked to concerns about the state of the global economic recovery.

- The small business optimism index increased 6.2 points in June to 100.6 when 96.7 was expected.

- The June consumer price index rose 0.6% when an increase of 0.5% was anticipated.

July 15, 2020

- A rocky ride altogether today as Goldman Sachs’ blowout earnings amid other positive bank earnings and promising vaccine news supported the market.

- Industrial production came in at 5.4%, higher than consensus; manufacturing at 7.2% was stronger than expected, and capacity utilization was at 68.6%.

July 16, 2020

- The broader market is lower due to concerns about the recovery in the global economy.

- Jobless claims in the week ended July 11 were 1,300,000 million when 1,288,000 million were expected.

- Retail sales in June were up 7.5% when a gain of 5.2% was anticipated and the July Philadelphia Federal Reserve business outlook index was 24.1, which compares to the estimate of 20.0.

July 17, 2020 (Mid-day)

- Stocks mid day are largely unchanged as investors attempt to digest economic news for a week that may end up mixed.

- Housing starts in June were 1,186,000 when 1,195,000 were expected and the more important permits number was 1,241,000 when 1,298,000 were anticipated.

- July consumer sentiment index came in lower than consensus at 73.2 when 70 was expected.

July 20, 2020

- Markets are higher as investors pin their hopes on central banks and governments doing more to support the economy.

- Lawmakers are scheduled to begin discussions for a second round of economic stimulus to help relieve households and businesses.

- No major economic reports scheduled for today.

July 21, 2020

- The S&P 500 has moved above June its high at 3220.50, signalling a potential resumption of the uptrend.

- Equity markets in the US and abroad jumped after European Union leaders reached a historic deal on a massive 750BN ($860BN) economic recovery plan.

- Discussions in Washington on fiscal stimulus will continue this week, hopefully agreeing to a solution before current programs expire at the end of the month.

- The Chicago Fed national activity index, which tracks overall economic activity and inflationary pressures, came in at 4.11, as compared with the previous month’s revised 3.50.

July 22, 2020

- The broader market advanced while the tech-heavy Nasdaq is taking a rest after reaching record highs last week.

- Existing home sales came in at 4.720 million, above 3.910 million consensus.

- After hours, stock futures are holding steady as Microsoft slides 2% after reporting earnings.