Upcoming Government Reports & Holidays

| Sep 01 | CONSTRUCTION SPENDING REPORT |

| Sep 02 | MANUFACTURERS’ SHIPMENTS, INVENTORIES & ORDERS REPORT |

| Sep 03 | US INTERNATIONAL TRADE IN GOODS & SERVICES REPORT |

| Sep 04 | EMPLOYMENT SITUATION REPORT |

| Sep 08 | QUARTERLY FINANCIAL REPORT – RETAIL TRADE |

| Sep 08 | QUARTERLY FINANCIAL REPORT – MANUFACTURING |

| Sep 10 | MONTHLY WHOLESALE TRADE: SALES & INVENT… |

| Sep 10 | PRODUCER PRICE INDEX REPORT |

| Sep 11 | CONSUMER PRICE INDEX REPORT |

| Sep 11 | QUARTERLY SERVICES SURVEY |

| Sep 16 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD… |

| Sep 16 | MANUFACTURING AND TRADE: INVENTORIES & SALES REPORT |

| Sep 17 | NEW RESIDENTIAL CONSTRUCTION |

| Sep 24 | NEW RESIDENTIAL SALES REPORT |

| Sep 25 | ADVANCE REPORT ON DURABLE GOODS – MANUFACTURERS’ SHIPMENTS… |

| Sep 29 | ADVANCE ECONOMIC INDICATORS REPORT |

Key Events That Moved the Market in August 2020

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

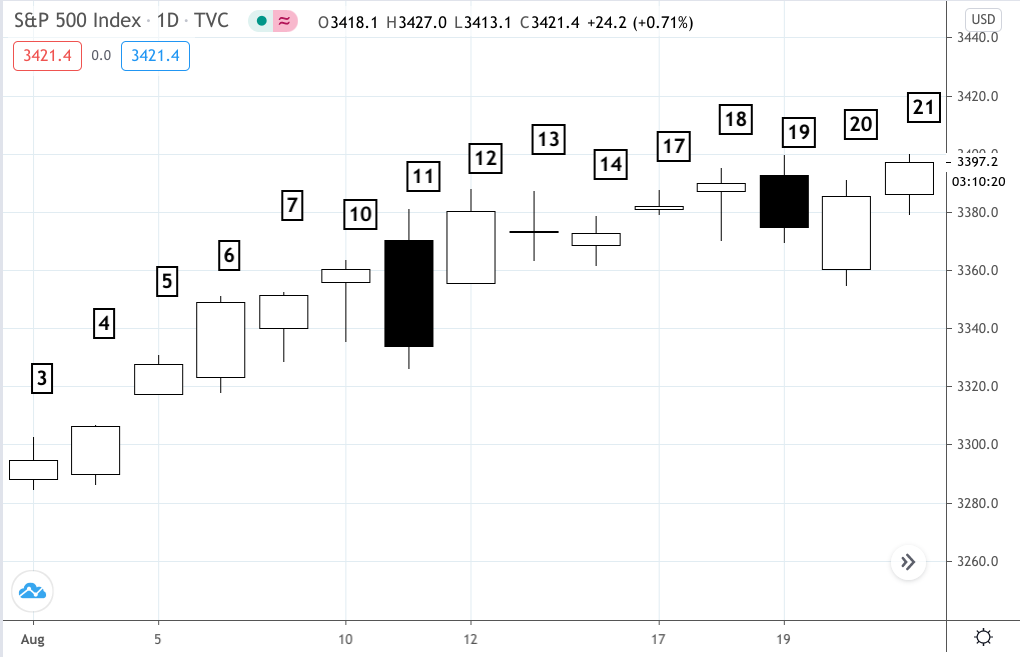

S&P 500 – Daily Chart – August 3 to 21, 2020 (Source: Tradingview)

August 3, 2020

- Markets start the month higher despite heightened geopolitical tensions.

- Stimulus discussions in Washington remain in focus.

- The 8:45 central time July manufacturing PMI index came in at 50.9, lower than the expected to be 51.3.

- The 9:00 July Institute for Supply Management index came in at 54.2, higher than the anticipated 53.5.

- June construction spending report decreased to -0.7%, missing estimates of 1.3%.

August 4, 2020

- Nasdaq hit a record high in the overnight trade but markets traded lower now as U.S.-China tensions and fiscal stimulus continue to worry the market.

- June factory orders report showed an increase, coming in at 6.2%, higher than the expected 5.2%.

August 5, 2020

- Markets advanced on stronger-than-expected corporate earnings reports.

- Nasdaq advancing to a record high.

- The ADP national employment change report was way off–showing employment with an increase of 167,000 in July when the market expectation was for a gain of 1.5 million.

- The July PMI services index came in at 50.0, slightly higher than the 49.6 that was expected.

- July Institute for Supply Management non-manufacturing index came in at 58.1 vs the expected figure of 55.

August 6, 2020

- The jobless claims report showed a smaller than expected number. Jobless claims in the week ended August 1 were 1,186,000 when 1,442,000 were anticipated.

- Markets largely rallied on that news.

August 7, 2020 (mid-day)

- Stocks gyrated between gains and losses in early trading on Friday as better-than-expected jobs data partially offset lingering tensions between China and the U.S., as well as ongoing coronavirus stimulus negotiations.

- Reporting mid-day, the Dow traded 34 points lower, or 0.12%, the S&P 500 remained flat, and the Nasdaq slid 0.36%.

August 10, 2020

- Markets are higher despite increased tensions between the U.S. and China and potential complications surrounding fresh federal stimulus spending plans.

- The S&P 500 futures hit the highest level since February 24 today and has recently filled the gap on the daily chart at 3300.75-3327.25 (record high for the September S&P 500 futures is 3396.50).

- The Labor Department’s June Job Openings and Labor Turnover Survey (JOLTS)–which tracks the monthly change in job openings and offers rates on hiring and quits–came in at 5.889, higher than the expected total of 5.288 million.

August 11, 2020

- Stocks attempted but failed to retake their February highs.

- There was a big slide in the Tech sector, with the tech-heavy Nasdaq now trailing below the S&P 500 and the Dow Jones.

- More remarkably was the plunge in gold and bonds.

August 12, 2020

- The consumer price index (CPI) came in at 0.6%, higher than the 0.3% consensus.

- Year over year change shows a figure of 1.0%, and minus food and energy, an uptick to 1.6%.

- A strong bounce in Tech carried the market to the cusp of a record high.

- Gold also rebounded along with stocks as demand for the yellow metal continues, many investors likely seeing the correction as a buying opportunity.

August 13, 2020

- US indices are flat as stimulus talks in Washington remain deadlocked.

- The S&P 500 is closing in on its record high at 3396.50.

- Jobless claims in the week ended August 8 came in under one million, specifically, at 963,000 when 1,150,000 were expected.

August 14, 2020 (mid-day)

- Reporting mid-day, the big three indexes are largely flat as talks in Washington over a fresh round of economic stimulus remain stalemated.

- Investors are awaiting trade talks between senior U.S. and Chinese officials, scheduled for Saturday.

- Retail sales in July rose 1.2% when a gain of 2.0% was expected, and retail sales less autos were up 1.9% when an increase of 1.5% was anticipated.

- July industrial production increased 3.0% as expected, and July capacity utilization was 70.6%, which compares to the predicted 70.3%.

August 17, 2020

- US indices advanced despite the stalemate in Washington over a fresh round of economic stimulus and ongoing US-China tensions.

- The August Empire State manufacturing index came in higher at 3.7 when 17 was expected.

- The August housing market index came in at 78, higher than the anticipated t72.

- The September S&P 500 futures is closing in on its record high of 3396.50.

August 18, 2020

- The Nasdaq advances to a record high.

- Stocks advance despite the stalemate in Washington over a fresh round of economic stimulus, along with ongoing tensions between the U.S. and China.

- There were 1.495 million building permits issued in July when 1.300 million were expected and there were 1.496 million starts, which compares to the anticipated 1.240 million.

August 19, 2020

- The S&P 500 and Nasdaq set new record setting highs but lost steam toward the end of the day.

- Federal Reserve FOMC minutes muted market optimism, stating that the economy is facing an “extraordinary level of uncertainty and risk” stemming from COVID-19, raising fears of a possible resurgence.

- Apple Inc hit a milestone, crossing $2 Trillion in market cap for the first time.

- Mortgage applications to purchase a home increased 1% for the week and were 27% higher compared with one year ago.

August 20, 2020

- Stocks drifted higher in choppy trading with the Dow snapping a three-day losing streak and the Nasdaq snatching a new high at the close.

- Disappointing economic news set the tone as the weekly jobless claims report came in once again over 1 million.

- But the market shrugged off the data, rising toward the end of the day.

August 21, 2020 (mid-day)

- Mid-day, stocks are rising, lifted by strong U.S. economic data, to end a week that saw the broader market reach a record level.

- The Dow Jones Industrial Average traded 140 points higher, or 0.5%. The S&P 500 gained 0.2%, and was on track for a record closing high. The Nasdaq Composite advanced 0.25%.