Upcoming Government Reports & Holidays

| 3-Dec | CONSTRUCTION SPENDING REPORT | 10:00 AM |

| 6-Dec | INTERNATIONAL TRADE REPORT | 8:30 AM |

| 6-Dec | MANUFACTURERS’ SHIPMENTS, INVENTORIES… | 10:00 AM |

| 6-Dec | US INTERNATIONAL TRADE IN GOODS & SERVICES | 8:30 AM |

| 7-Dec | EMPLOYMENT SITUATION REPORT | 8:30 AM |

| 7-Dec | MONTHLY WHOLESALE TRADE: SALES & INVENTOR… | 10:00 AM |

| 7-Dec | WHOLESALE TRADE REPORT | — |

| 11-Dec | PRODUCER PRICE INDEX REPORT | 8:30 AM |

| 12-Dec | CONSUMER PRICE INDEX REPORT | 8:30 AM |

| 14-Dec | ADVANCE MONTHLY SALES FOR RETAIL & FOOD… | 8:30 AM |

| 14-Dec | MANUFACTURING AND TRADE: INVENTORIES &… | 10:00 AM |

| 18-Dec | NEW RESIDENTIAL CONSTRUCTION REPORT | 8:30 AM |

| 21-Dec | ADVANCE REPORT ON DURABLE GOODS | 8:30 AM |

| 21-Dec | GROSS DOMESTIC PRODUCT REPORT | 8:30 AM |

| 24-Dec | CHRISTMAS EVE | — |

| 25-Dec | CHRISTMAS DAY | — |

| 27-Dec | NEW RESIDENTIAL SALES REPORT | 10:00 AM |

| 28-Dec | ADVANCE ECONOMIC INDICATORS REPORT | 8:30 AM |

| 31-Dec | NEW YEAR’S EVE | — |

Key Events That Moved the Market in November 2018

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

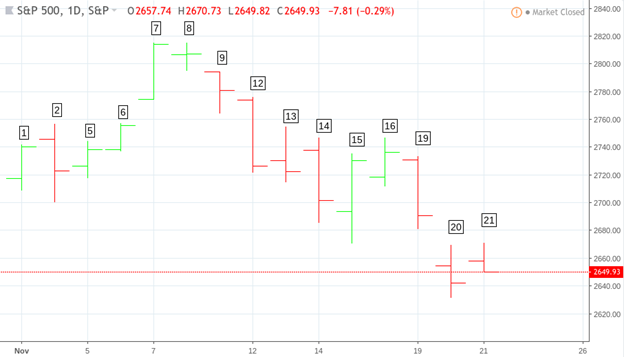

Above: S&P 500 Index Daily Chart from November 1 to November 21, 2018

November 1

- Rumors that China may be implementing stimulus measures to boost their deteriorating economy may have contributed to lifting global equity markets.

- US indices are up for third day in a row possibly due to a series of positive earnings reports.

- Jobless claims were at 214,000, slightly higher than economist expectations of 211,000.

November 2

- The US economy added 250,000 more jobs, contributing to the early bullishness in the market.

- Labor participation rate edged up, average hourly wages rise by $0.05, and the jobless rate remains at a multi-year low.

- Global equity markets remained optimistic following a call between President Trump and Chinese President Xi.

- Yet, Apple fell sharply on a less-than-optimistic outlook, leading the NASDAQ downward.

- Continuing trade fears, in addition to tech, may have caused the broader market to reverse mid-day, though an afternoon announcement by President Trump that a trade deal with China was underway may have contributed to lifting the markets from its lows toward the end of the day’s session.

November 5

- Markets traded in a relatively narrow range as traders anticipated the following day’s midterm elections.

- ISM non-manufacturing indexed slowed to 60.3, though higher than the anticipated 59.2 expectation.

November 6

- Job openings fell by 284,000 o 7.009 million in September, well below consensus expectations of 7.11 million.

- As traders anticipate the results of the midterm elections, the low interest rate environment may be largely supportive of today’s stock market rise.

November 7

- US indices advanced sharply as the midterm elections divided Congressional control.

- This was the sharpest post-midterm election rise since 1982.

- Historically, the third presidential term has been bullish for the stock market following midterm elections; a seasonal factor which may (or may not) contribute to the current market.

- Consumer credit growth, at $10.9 billion, slowed below expectations of the $16.5 billion consensus.

November 8

- Initial jobless claims decreased by 1,000 though edged toward the higher end of expectations.

- The FOMC kept the federal funds target unchanged within a range of 2.00 to 2.25 percent, signalling another rate hike in December.

- Markets were relatively unchanged at the end of the day.

November 9

- Energy market stocks tumbled as US crude oil futures entered a bear market.

- S&P 500 along with the Nasdaq Composite ended in the red while the Dow continued its winning streak.

November 12

- Fears of a slowing global economy plus ongoing European political uncertainties contributed to US indices moving lower.

- Apple shares fell, and with no economic reports on this day (US Veterans Day) bullish traders and bargain hunters remained on the sidelines.

November 13

- US indices started moving toward the upside as reports that the US and China talks were moving along sparked some optimism in the markets.

- Stocks quickly reversed, however, as falling oil prices raised the fears of slowing global economic growth.

- Budget deficit at $-100.5 billion fell slightly lower than expectations though it remains 59% larger than the $-63.2 billion deficit from October of 2017.

November 14

- Headline inflation came in at the consensus at 0.3%. The core rate, excluding energy and food, came in as expected at 0.2%.

- Jerome Powell spoke, emphasizing once again that gradual rate hikes are central to the Fed’s commitment toward maintaining and extending the current economic expansion.

- Stocks were attempting to regain ground from the previous day’s decline but the continuing slide in crude oil prices brought indices down with it.

November 15

- Indices recovered from the previous 4-day slide after a slew of favorable economic data.

- Jobless claims increased by 2,000 for the week ending November 10; a steady and favorable, albeit higher, rate.

- Retail sales at 0.8% surged beyond the consensus range of 0.5% to 0.7%%.

- the Empire State Manufacturing index came in stronger than forecast at 23.3, despite higher input costs.

November 16

- Industrial production report came in within the consensus range for production, manufacturing, and capacity utilization. The gain for manufacturing led by business equipment and construction supplies is the good news in today’s report and points to a healthy conclusion for what has been a positive 2018 factory sector.

November 19

- Vice President Mike Pence’s comments on Sunday that there will be no end to US tariffs on $250 billion of Chinese goods unless China changes its ways contributed to Monday’s market plunge.

- The Dow Jones fell 400 points, as tech behemoths Apple, Amazon, and Facebook drag down the Nasdaq Composite.

- The housing market bucked lower significantly. With consensus range between 66 to 69, the November Housing Market Index report logged in at 60.

November 20

- Although yesterday’s housing market index surprisingly plummeted, today’s Housing Starts came within expectation at 1.228 M with consensus expectations ranging between 1.180 to 1.269 M.

- CNBC released its Global CFO Council survey–representing CFOs from the largest companies in the world–in which over 50% had expectations that the Dow may fall an additional 2,000 points before the market sell-off ends.

- The Dow slid another 600 points, completely erasing its 2018 gains.

- With rate hikes expected in December, the biggest concern among most financial institutions is the uncertainty caused by the ongoing tariff-driven trade war; this in addition to the political uncertainty in Europe and the overall slowing growth in the global economy.

November 21

- The Dow started the day with a 200 point gain but was erased toward the end of the trading day as Apple falls.

- Potential progress in upcoming US and China talks, plus news that the Fed may consider holding of its monetary tightening policy until next contributed to early optimism in today’s markets.

- Weekly U.S. jobless claims increased 3,000 to a seasonally adjusted 224,000, far above expectations of 215,000.

- Indices have historically traded higher the day before Thanksgiving Day.