Upcoming Government Reports & Holidays

| Dec 01 | CONSTRUCTION SPENDING REPORT |

| Dec 03 | MANUFACTURERS’ SHIPMENTS, INVENTORIES… |

| Dec 04 | EMPLOYMENT SITUATION REPORT |

| Dec 07 | US INTERNATIONAL TRADE IN GOODS & SERVICES… |

| Dec 07 | QUARTERLY FINANCIAL REPORT: MANUFACTUR… |

| Dec 07 | QUARTERLY FINANCIAL REPORT: RETAIL TRADE |

| Dec 08 | BUSINESS FORMATION STATISTICS |

| Dec 09 | MONTHLY WHOLESALE TRADE: SALES & INVEN… |

| Dec 10 | QUARTERLY SERVICES SURVEY |

| Dec 10 | CONSUMER PRICE INDEX REPORT |

| Dec 11 | PRODUCER PRICE INDEX REPORT |

| Dec 15 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD… |

| Dec 15 | MANUFACTURING AND TRADE: INVENTORIES… |

| Dec 16 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| Dec 23 | ADVANCE REPORT ON DURABLE GOODS – MAN… |

| Dec 23 | NEW RESIDENTIAL SALES REPORT |

| Dec 28 | PRELIM. US IMPORTS FOR CONSUMPTION OF… |

| Dec 29 | ADVANCE ECONOMIC INDICATORS REPORT |

Key Events That Moved the Market in November 2020

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

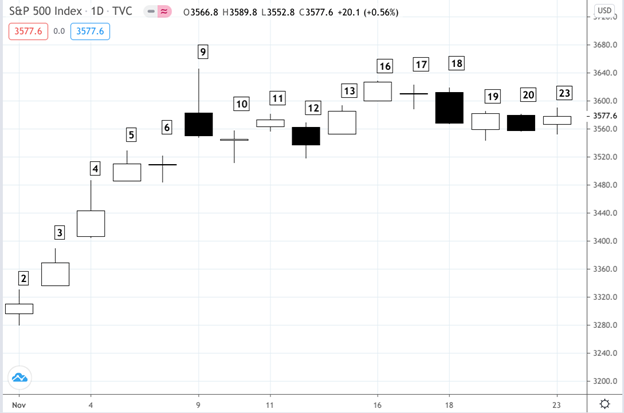

S&P 500 – Daily Chart – November 2-23, 2020 (Source: Tradingview)

November 2, 2020

- The broader market is sharply higher on limited news.

- The 8:45 central time October manufacturing PMI came in at 53.4, in line though slightly higher than the expected 53.3.

- The October ISM manufacturing index came in at 59.3 topping expectations of 55.7.

- September construction spending rwas 0.3%, lower than the 0.9% consensus expectations.

November 3, 2020

- Stocks continued to advance on limited news.

- The 9:00 September factory orders report showed an increase of 1.1, higher than the expectations of 0.6%.

- Once the political uncertainties settle down, the globally low interest rate environment will likely dominate.

November 4, 2020

- Markets are sharply higher despite uncertainties surrounding the inconclusive outcome to the U.S. presidential election, with no clear winner yet apparent.

- Mortgage applications in the U.S. jumped 3.8% in the week ended October 30, following a 1.7% increase in the previous week, according to the Mortgage Bankers Association.

- Private sector employment increased by 365,000 jobs from September to October according to the October ADP National Employment Report when 650,000 were expected.

- The October Markit services PMI final will be released at 8:45 central time. Last month the report showed 56.

November 5, 2020

- Stocks are sharply higher and are up for the fourth consecutive day despite uncertainties surrounding the inconclusive outcome to the U.S. presidential election.

- Jobless claims in the week ended October 31 were 751,000 when 745,000 were expected.

- Major central banks around the world are under pressure to add more accommodation.

- Jerome Powell notes that no further monetary stimulus will be taken at the moment, emphasizing the importance of fiscal actions to avoid further significant downside risks.

- Powell notes that the path to economic recovery significantly depends on the course of the COVID spread.

November 6, 2020

- Markets remained unchanged as investors sought clarity around the presidential and congressional election results.

- Market sentiment was kept in check by better-than-expected U.S. unemployment data.

- The Dow Jones Industrial Average traded 64 points lower, or 0.2%. The S&P 500 fell 0.1% along with the Nasdaq Composite.

November 9, 2020

- S&P 500, Dow and Russell 2000 shot up to record highs due to vaccine progress and ongoing pressure for central banks to add even more accommodation.

- There are no major economic reports scheduled for today.

November 10, 2020

- The broader market was mixed today, taking a breather from yesterday’s staggering rally.

- The National Federation of Independent Business (NFIB) optimism index remained at 104.0 in October, which compares to the median expectation of 104.8.

- The small business optimism index is compiled from a survey that is conducted each month by the National Federation of Independent Business of its members.

- The 9:00 central time September Job Openings and Labor Turnover Survey (JOLTS) came in at 6.436 million, lower than the expected 6.508 million. The Labor Department’s JOLTS report tracks monthly changes in job openings and offers rates on hiring and quits.

November 11, 2020

- The broader market continues to fluctuate, partly supported by optimism toward vaccine progress, plus ongoing pressure on central banks to add more accommodation.

- Today’s gains are being led by the NASDAQ.

- Mortgage applications in the U.S. fell 0.5 percent in the week ended November 6, which is the first decline in three weeks and after a 3.8 percent advance in the previous period, according to the Mortgage Bankers Association.

November 12, 2020

- Tech stocks are pulling ahead driving the Nasdaq as the other two major indexes fall.

- Jobless claims in the week ended November 11 were 709,000, better than the 737,000 expected.

- The October consumer price index was unchanged when an increase of 0.2% was expected.

- The consumer price index, excluding food and energy, remained unchanged, which compares to the anticipated 0.2% gain.

November 13, 2020

- Wall Street ended with a strong week in the market as investors look past the COVID-19 case surges toward a more freed-up economy in the coming months.

- However, fading hopes for fiscal stimulus limited the advance.

- The October producer price index was up 0.3% when an increase of 0.2% was expected and the producer price index, excluding food and energy, was up 0.1%, which compares to the anticipated 0.2% gain.

- November consumer sentiment index came in at 77.0, far below analyst estimates of 82.

November 16, 2020

- Broader stock indexes are slightly higher on increased vaccine optimism.

- The November Empire State manufacturing index, representing a variety of industries in New York, was 6.3–lower than the 13.5 was expected.

November 17, 2020

- The stock market is lower today, paring back yesterday’s advance.

- October retail sales increased 0.3% when a gain of 0.4% was expected and retail sales excluding vehicles were up 0.2% when a gain of 0.5% was anticipated.

- October Industrial production increased 1.1%, which compares to the predicted 1.0% gain and October capacity utilization was 72.8% when 72.2% was estimated.

- The November housing market index surged to 90, far above the expected figure of 85.

November 18, 2020

- Today marked a second day that was sluggish overall for stocks.

- Investors are still digesting the recent sharp rally against the news of increasing COVID infections and potential shutdowns.

- There was very little in the way of economic reports to fuel market movement.

November 19, 2020

- The broader market continues to regroup as investors decide whether to get more aggressive in the markets amid rising pandemic cases and looming shutdowns.

- Jobless claims came in at 742,000–much higher than the 710,000 analysts had expected.

- On the brighter side of things, existing home sales in October jumped to 6,850 million versus the expected figure of 6.470 million–a 26.6% year over year increase and a 4.3% higher month over month.

November 20, 2020

- A sluggish end to an indecisive market, the major stock indexes slid as rising new coronavirus cases, coupled with questions around central-bank funding for key emergency programs, cast doubt on a swift economic recovery.

November 23, 2020

- Markets moved higher on Monday as investors are focusing on the potential economic recovery prospects for 2021.

- The composite PMI came in higher at 57.9 above consensus of 55.6.

- Composite Purchasing Managers’ Index (PMI) provides an early estimate of current private sector output by combining information obtained from surveys of around 1,000 manufacturing and service sector companies.

- Due to the Thanksgiving Holiday, investors await a wide heap of reports from Consumer Confidence (Tuesday) to Jobless Claims and FOMC minutes to be released this Wednesday.