Upcoming Government Reports & Holidays

| May 03 | CONSTRUCTION SPENDING REPORT |

| May 04 | US INTERNATIONAL TRADE IN GOODS & SERVICES… |

| May 04 | MANUFACTURERS’ SHIPMENTS, IN… – FULL REPORT |

| May 07 | EMPLOYMENT SITUATION REPORT |

| May 07 | MONTHLY WHOLESALE TRADE: SALES & INV… |

| May 12 | CONSUMER PRICE INDEX REPORT |

| May 12 | BUSINESS FORMATION STATISTICS |

| May 13 | PRODUCER PRICE INDEX REPORT |

| May 14 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD… |

| May 14 | MANUFACTURING AND TRADE: INVENTORIES & SA.. |

| May 18 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| May 20 | ADVANCE SERVICES REPORT |

| May 25 | NEW RESIDENTIAL SALES REPORT |

| May 26 | PRELIMINARY US IMPORTS FOR… STEEL… |

| May 27 | ADVANCE REPORT ON DURABLE GOODS – MANUF… |

| May 28 | ADVANCE ECONOMIC INDICATORS REPORT |

| May 31 | MEMORIAL DAY |

————————————

Key Events That Moved the Market in Apr 2021

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

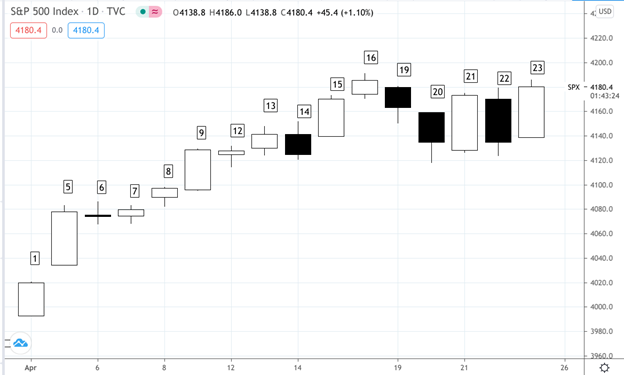

S&P 500 – Daily Chart – April 1-23, 2020 (Source: Tradingview)

Thursday – April 1

- A new month, quarter and milestone for the stock market, the S&P 500 powered through the 4,000 level for the first time.

- The market appears its rotational shift from cyclical stocks to big growth names and back allowing the more overheated sectors to cool off.

- Jobless claims came in much higher than expected with 719,000 new claims last week over the expected 658,000.

- March’s flash PMI came in strong at 59.1, slightly higher than the expected 59.0 consensus.

- With orders exceptionally strong, deliveries exceptionally slow and costs surging, ISM’s manufacturing sample is at risk of overheating. Consensus for March’s index is 61.5 versus February’s 60.8 which easily exceeded Econoday’s high estimate.

- Construction spending in January got a long delayed boost from the nonresidential side of the report, making for an overall gain of 1.7 percent that far exceeded consensus range. In February it showed a total decline of 0.8 percent, in line with consensus expectations.

Friday – April 2 – Good Friday

- Markets closed – Good Friday

- The Employment Situation shows a promising picture despite yesterday’s jobless claims as 916,000 new jobs were added to the economy in addition to the unemployment rate dropping to 6.0% from its prior 6.2%.

Monday – April 5

- The record rally rolled on as stocks moved higher following a batch of blowout economic data with the S&P reaching another record high.

- The jobs report last Friday had investors celebrating after the economy added 916,000 jobs way above the 675,000 economists were expecting.

- PMI composite final for March came in on the top end of expectations with a figure of 59.7, slightly above the expected 59.1.

- February factory orders fell to -0.8%, slightly below -0.5% consensus.

- March ISM services index came in strong at 63.7, well above expectations of 58.6.

Tuesday – April 6

- Stocks took a breather but not until after the S&P hit another intraday record high.

- Job openings in February grew as the JOLTS report came in at 7.367 million roping expectations of 6.850 million.

Wednesday – April 7

- Stocks drifted around in sluggish trading although the S&P managed another record close and the Dow ended the day with a slight gain.

- Consumer credit in February logged the largest “beat” on record, coming in at $27.6 billion when economists were expecting around $2.6 billion–a nearly 10-fold surprise.

- This indicates that Americans are feeling confident enough in the economy not only to spend but to go into credit card debt.

Thursday – April 8

- It was another mixed session for stocks though the S&P closed at another record high and the Dow advanced to close just shy of another record high.

- Fed Chair Jerome Powell spoke at the IMF seminar on a panel in which he struck a dovish tone, giving no indication of rate hikes anytime soon, saying that “the economic recovery remains incomplete and uneven.”

- On the jobs front, last week saw 744,000 new jobless claims filed, topping expectations of 680,000 thousand.

Friday – April 9

- The S&P 500 traded near record highs as Wall Street is set to wrap up the week with solid gains.

- The producer price index, which measures wholesale price inflation, jumped in March, showing a rise of 1.0%, compared with a projected increase of 0.4% from economists.

- Year over year, the PPI surged 4.2%, which marks the largest annual gain in more than nine years.

- Investors shrugged off the jump in jobless claims from last week. The Labor Department reported first-time claims for the week ended April 3 totaled 744,000, well above the expectation for 694,000 from economists surveyed by Dow Jones.

- Fed Chair Jerome Powell called the recovery from the pandemic “uneven” on Thursday, signaling a more robust recovery is needed.

Monday – April 12

- It was a fairly quiet Monday with the S&P ending flat.

- Investors are waiting for the start of earnings season this Wednesday, starting with financials

- The market is expecting upbeat earnings and optimistic commentary from the CEOs of the banks and financial institutions reporting first.

- There were no major economic reports today.

Tuesday – April 13

- The day ended mixed as the Dow closed down while the S&P 500 and Nasdaq closed up by the end of the trading day.

- The J&J vaccine recall put a bit of a hamper on the brighter news that otherwise would have lifted the market.

- Contrary to the optimism resulting from its report, the March Consumer Price Index (CPI) jumped year over year to 2.6%; minus food and energy costs, it stands at 1.6%.

- Note that this stands within the consensus range and close to the actual consensus figures expected by economists.

- Investors are hopeful that the Federal Reserve can maintain control over the inflation rate, as Fed chair Powell has often stated.

- The March NFIB Small Business optimism index came in at 98.2, higher than last month’s 95.8 but lower than the expected 99.0–meaning, optimistic enough, but with caution.

Wednesday – April 14

- It was a choppy day but the Dow and S&P 500 hit record intraday highs before losing steam into the close.

- Bitcoin closed at a record high as Coinbase IPO debuted opening at $380 per share and closing at $328–a valuation close to $100 billion.

- Earnings season kicked off with mind-boggling results; Goldman Sachs reported earning 80% above analyst expectations; JP Morgan reported 48% above consensus; Wells Fargo, 50% above.

- These earnings beats, however, were attributed to trading profits and the release of loan loss provisions (money set aside for bad loans) rather than revenue generated from new loans; hence, the market response to these banks’ shares were muted.

- Fed chair Jerome Powell acknowledged the rise in inflation, claiming–as the market believes him for now–that inflation is not a big problem.

Thursday – April 15

- The stock market climbed to record levels after financial companies reported strong earnings and economic data pointed to a rebound in consumer spending and jobs.

- Retail sales surged 9.8% in March as additional stimulus sent consumer spending soaring.

- First-time filings for jobless claims dropped to the lowest level since March 2020–only 576,000 new claims for the week ended April 10 versus economist expectations of 710,000.

Friday – April 16

- Stocks are on the rise again as the market’s record run continues amid strong earnings from blue-chip companies as well as encouraging data signaling a bounce back in the economy.

- Morgan Stanley–the last of the six largest U.S. banks reported a strong earnings beat, bolstered by trading profits and investment banking results.

- Wall Street is poised to wrap up another winning week–the S&P 500 gaining 1.3%, the Dow climbing 1%, and the Nasdaq rising 0.9%.

- Investor sentiment rose thanks to a slew of economic data this week pointing to a rebound in consumer spending, sentiment and the jobs market.

- The preliminary consumer sentiment index rose to a one-year high of 86.5 in the first half of this month from 84.9 in March.

- The Federal Reserve’s Christopher Waller said the US economy is poised to take off, yet there’s still no reason to start tightening policy.

Monday – April 19

- The broader market experienced its own version of a Manic Monday as stocks slipped into the close.

- Tech stocks led the fall with FAANG stocks taking the hardest hit.

- EV also got slammed amid news of the Tesla weekend crash, prompting investors to question the company’s driverless ambitions.

- No major economic reports were released today.

Tuesday – April 20

- Today was another rocky session for the stock market with the worst two-day slide in over a month.

- The Dow fell as much as 390 points though ending the day down 260 points.

- The tech sector and airline industry led the market down for the most part as investors sought a more defensive positioning in the market.

- No major economic reports were released today.

Wednesday – April 21

- Stocks turned positive today shortly after the open after the two-day slide that preceded it.

- The good news is that corporate earnings guidance, across a wide swathe of sectors, is back once again, hinting at enough economic stability to forecast performance in the coming quarters.

- Additionally, many companies have been upping their forecasts in the quarters to come.

- The bad news is that many analysts are thinking this might be “as good as it gets,” that we’re hitting peak earnings and peak recovery, and that everything positive is already priced-in.

- Another worrying sign is that the market hasn’t had a major dip since last Fall and volatility is nowhere to be seen–a worrying sign of complacency or perhaps even exuberance.

- New mortgage application revealed some optimism, the composite index up 8.6% against the prior week’s -3.7%.

- Mortgage applications for new purchases was up 6.0% from last week’s -1.0%; and refis jumped up 10.0% versus last week’s -5.0%.

Thursday – April 22

- All major US stock averages were down around 1% with the Dow plunging over 400 points before ending the day with a 320-point drop.

- Tax talk spooked the market, as the White House proposed raising the capital gains tax rate to 39.6% for Americans earning more than $1 million a year.

- Initial jobless claims ending 4/17 came in much lower than expected, at 547,000 new claims versus the anticipated 615,000.

- March new home sales stood at 6.010 million, slightly below analyst expectations of 6.205 million.

- Home sales are down -3.7% month over month but up 12.3% year over year.

Friday – April 23

- Stocks rebounded as investors reassessed concerns regarding the White House’s capital gains tax hike proposal.

- Bloomberg News reported that the Biden plan can result in a capital gains tax hike to as high as 43.4% for Americans making over $1 million a year.

- But with the Democrats’ narrow majority control in Congress, the tax bill like this could face challenges, and many on Wall Street believe that a less dramatic increase is more likely.