Wouldn’t it be great to know what the majority of short-term traders and longer-term investors are thinking about a given market or asset? If you were able to perceive what these two distinct groups were thinking, then such knowledge might help you make better and more timely buying and selling decisions.

The bad news is that garnering such information in real time may be next to impossible. The good news is that if you trade trends, and don’t mind a little bit of lag, then you can create a “proxy” for short-term and long-term market sentiment, using a set of moving averages.

Introducing the Guppy Multiple Moving Average Indicator

Developed by trader and financial columnist Darry Guppy, the Guppy Multiple Moving Average (GMMA) is an indicator that uses two groups of 6 moving averages (12 in total) representing short-term and long-term sentiment. You can also use simple, exponential, or weighted MAs depending on your preference.

- The short-term MAs are often set to the 3, 5, 8, 10, 12, and 15-day periods.

- The longer-term MAs are typically set to the 30, 35, 40, 45, 50, and 60-day periods.

Here’s what the GMMA looks like:

ES – Daily March 30, 2020 – April 6, 2021 (source; Tradingview)

Let’s take a closer look at what it might indicate. Let’s start with a strong trend.

ES Daily – December 15, 2020 – April 6, 2021 (source: Tradingview)

Here’s an example of a sideways market.

Silver futures (SI) Daily – September 14, 2020 – April 6, 2021

- When both sets of moving averages are expanded, it indicates that the trend is strong (metaphor: think of how a strong wind inflates the sails on a boat).

- When a gap between both sets of a moving average begins to widen, that too indicates a strong trend.

- When either MA sets begin to fold into one another, then “trend sentiment” may be weakening.

As you can see, the GMMAs provide a proxy illustration of how short-term traders may be thinking about a given market versus longer-term investors.

What Are the GMMA Limitations

Like every moving average, the GMMA is lagging. It’s not predictive. Instead it tells you the current strength of a trend based on its history.

In periods of consolidation, the GMMA will show a series of whipsaws (as in the silver futures example above). This is not so much a limitation but rather an approximate representation of market sentiment–namely, that it’s undecided and uncertain.

The GMMA does not give a comprehensive picture of the entire market context. If the short-term MAs fold into the longer term MAs as in the example below…

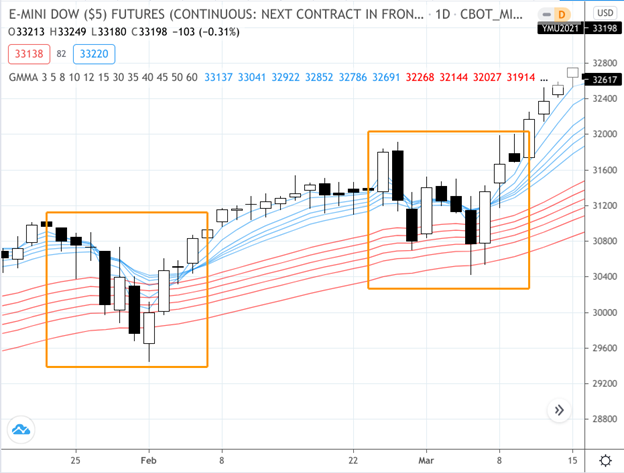

DJIA futures (YM) Daily – January 19 – March 15, 2021 (source: Tradingview)

How might you tell if either decline might have indicated a trend reversal or a mere pullback?

To help you answer that question, here are a few trading tips to help you make use of the GMMA from a more responsible angle.

Tips for Using the GMMA Indicator

Always check the fundamental environment to gauge the likelihood of a pullback versus a reversal.

Pullbacks are strong entry points as long as they are indeed “pullbacks” (and not reversals).

It would be unwise to use MA crossovers as entry signals. You’ll get wrecked in a series of whipsaws if the market goes into a period of sideways consolidation.

Notice how gaps between both sets of MAs eventually close down? You might be able to use this to estimate your entries (if you’re trading with the trend) or your countertrend positions (if you’re trading against it).

Periods in which both MAs are folded-in and tight–a result of low volatility–are likely to be followed by explosive moves up or down. This may provide opportunities for long-volatility strategies such as neutrally-positioned breakouts or straddles (using options).

The Bottom Line

The GMMA illustrates trend strength in a way that is unique, clear, and can be relatively actionable. Despite its limitations, if you can use it properly for what it’s designed to show, then it may be worth adding to your technical analysis toolbox for analysis and strategizing your trades.

Please be aware that the content of this blog is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations. There is a substantial risk of loss in trading futures, options and forex. Past performance is not necessarily indicative of future results.