Upcoming Government Reports & Holidays

| Nov 01 | CONSTRUCTION SPENDING REPORT |

| Nov 02 | HOUSING VACANCIES & HOMEOWNERSHIP |

| Nov 03 | MANUFACTURERS’ SHIPMENTS, INVENTORIES… |

| Nov 04 | US INTERNATIONAL TRADE IN GOODS & SERVICES… |

| Nov 06 | EMPLOYMENT SITUATION REPORT |

| Nov 10 | MONTHLY WHOLESALE TRADE |

| Nov 12 | CONSUMER PRICE INDEX REPORT |

| Nov 13 | PRODUCER PRICE INDEX REPORT |

| Nov 16 | ADVANCE MONTHLY SALES FOR RETAIL & FOOD… |

| Nov 16 | MANUFACTURING AND TRADE: INVENTORIES… |

| Nov 17 | NEW RESIDENTIAL CONSTRUCTION REPORT |

| Nov 19 | ADVANCE SERVICES REPORT |

| Nov 24 | ADVANCE ECONOMIC INDICATORS REPORT |

| Nov 24 | ADVANCE REPORT ON DURABLE GOODS… |

| Nov 24 | NEW RESIDENTIAL SALES REPORT |

| Nov 24 | PRELIM. US IMPORTS FOR CONS. OF STEEL… |

Key Events That Moved the Market in October 2020

The following is a review of US and world events from the last month. Please be advised that this content is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations.

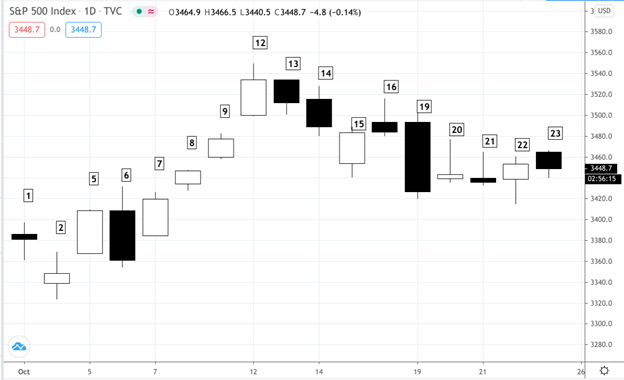

S&P 500 – Daily Chart – October 1-23, 2020 (Source: Tradingview)

October 1, 2020

- Markets are higher for a second day due to the recent mostly stronger than expected economic reports.

- It also appears likely tat policymakers will come up with a compromise stimulus deal.

- Jobless claims in the week ended September 26 were 837,000 when 850,000 were expected.

- August personal income fell 2.7% when down 2.5% was anticipated.

- September’s PMI manufacturing final index came in at 53.1, slightly lower than the anticipated figure of 53.5.

- The September Institute for Supply Management manufacturing composite index came in lower at 55.4, lower than the consensus of 56.3,

- August construction spending report came in at 1.4%, topping expectations of 0.7%.

October 2, 2020

- Markets plunged overnight, the Dow Futures falling 400 points, on news that President Trump tested positive for COVID-19.

- Later in the morning, markets bounced back, shaking off Trump’s COVID test on renewed hopes of a stimulus deal.

- Also weighing on market sentiment was a worse-than-expected September jobs report.

- While economists expected job growth of 800,000, the actual figure turned out to be 661,000 in September.

- In contrast to the negative jobs report, consumer sentiment rose sharply, coming in at 80.4, topping analyst expectations of 79.0.

October 5, 2020

- US markets are higher due to optimism about the economic recovery. Traders remain sensitive to any signals about the state of President Donald Trump’s health.

- Investors are closely monitoring developments in fiscal aid talks in Washington.

- September PMI composite final index came in at 54.3, meeting expectations of 54.4.

- September Institute for Supply Management services index came in at 57.8, higher than the anticipated figure of 56.3.

October 6, 2020

- Jerome Powell is once again calling on Capitol Hill to implement a second wave of fiscal stimulus, otherwise “typical recessionary dynamics” could result in a downward spiral of economic weakness. He said any damage from “overdoing” stimulus would be less significant, in what the Fed chief framed as an “asymmetric” policy risk. Without further fiscal stimulus, he warned that bankruptcies, both personal and business, could further rise resulting in systemic damage to productive capacity and long-term wage growth.

- The August Job Openings and Labor Turnover Survey (JOLTS) report was expected to show 6.25 million but came in higher at 6.493 million.

October 7, 2020

- Markets advanced as investors assessed the potential for additional fiscal spending in coming weeks after President Trump appeared to soften his earlier position regarding offering support to households, airlines and small businesses.

- Mortgage applications in the U.S. increased 4.6% in the week ended October 2, according to the Mortgage Bankers Association.

- The 2:00 central time August consumer credit report was expected to show a $14.6 billion increase but instead showed a decrease of -$7.2 billion.

October 8, 2020

- The broader market moved higher as investors assess the potential for additional fiscal spending in coming weeks after President Donald Trump recently appeared to soften his earlier position regarding offering support to households, airlines and small businesses.

- President Trump said, “stimulus talks are starting to be productive.

- Jobless claims in the week ended October 3 were 840,000 when 819,000 were expected.

- S&P 500 futures hit their highest level since September 8.

October 9, 2020

- US indexes rise, extending the rally for the third straight session due to renewed hopes of further stimulus.

- Stock index futures are on course for the best week since August.

October 12, 2020

- US stock indices are higher extending the rally for the fourth straight session.

- The U.S. third-quarter corporate earnings reporting season will kick off this week.

- Note that according to FactSet data, analysts are expecting a -20.5% earnings decline across the S&P 500.

- CFRA analysts sees 90% of the S&P 500’s sub-industries posting declines

October 13, 2020

- Q3 corporate earnings reporting season kicks off today with several large U.S. banks reporting this morning.

- The National Federation of Independent Business optimism index increased 3.8 points to 104.0 in September, which is the highest level since February.The median estimate was 100.9. The NFIB is a monthly assessment of small businesses in the U.S., which account for almost half of the private sector jobs.

- The September consumer price index was up 0.2%, as anticipated.

October 14, 2020

- US stocks started the day higher but slipped after a mixed bag of quarterly earnings reports from major Wall Street banks and on doubts about additional fiscal stimulus following an impasse in Washington.

- The September producer price index increased 0.4%, slightly over the expected 0.2%.

October 15, 2020

- Markets tumbled as the US stimulus bill is looking more unlikely before the election.This fundamental piece of the puzzle is what’s dominating price movements in all of the financial markets

- Jobless claims in the week ended October 10 were 898,000–much worse that the anticipated 825,000.

- The October Empire State manufacturing index was 10.5, which compares to the anticipated 14.5.

- The October Philadelphia Federal Reserve manufacturing index was 32.3 when 14.5 was predicted.

October 16, 2020

- Indexes are higher after the September retail sales report showed an increase of 1.9%, beating consensus expectations of 0.7%.

- Washington continues to send mixed signals about the progress of a stimulus deal.

- September industrial production fell 0.6% when economists expected an increase of 0.6%; September capacity utilization was 71.5%.

- October consumer sentiment index came in at 81.2, higher the estimated figure of 80.5

October 19, 2020

- The broader market buckled in the absence of progress on fiscal stimulus and with a heavy week of earnings ahead.

- The October housing market index came in at 85, slightly topping expectations of 83.

October 20, 2020

- Stocks rebounded slightly, retaining their uptrend somewhat as talks of fiscal stimulus remain alive, albeit stalemated.

- Heavy selling yesterday was due to concerns that lawmakers were not making progress on a deal.

- Housing starts in September were 1.415 million when 1.463 million were expected and building permits were 1.553 million, which compares to the anticipated 1.520 million.

October 21, 2020

- Markets advance as investors await developments on a fresh stimulus bill.

- The indexes attempted to rally but that soon faded, though no real harm was done.

- Earnings also kept the market in check on a day where no major economic reports were to be released.

- The main story besides earnings is stimulus talks, which appear to be making progress but hasn’t yielded anything conclusive.

October 22, 2020

- A rise in bond yields reshuffled stock market leadership on the way to a modest advance as investors await

- Negotiators failed to announce a deal on Wednesday and will speak again today.

- Weekly jobless claims were better than expected. Jobless claims in the week ended October 17 were 787,000 when 865,000 were anticipated.

- The September existing home sales report showed that 6.5 million homes were sold, slightly above consensus expectations of 6.2 million.

October 23, 2020 (mid-day)

- Markets have fallen as investors weigh the potential for additional fiscal stimulus.

- Intel shares are leading the broader tech sector lower.

- As of mid-day, the Dow Jones Industrial Average has fallen 199 points, or 0.7%. The S&P 500 slid by 0.3% and the Nasdaq Composite declined by 0.4%.

- The Dow and S&P 500 are on track to snap a three-week winning streak and the Nasdaq is headed for its first weekly loss in five weeks.

- More than a quarter of companies in the S&P 500 have reported through Thursday, and 83% of them have beaten analysts’ forecasts for earnings-per-share, according to FactSet.