Upcoming Government Reports & Holidays

| 1-Oct | CONSTRUCTION SPENDING | 10:00 AM |

| 4-Oct | MANUFACTURERS’ SHIPMENTS, INVENT… | 10:00 AM |

| 5-Oct | EMPLOYMENT SITUATION REPORT | 8:30 AM |

| 5-Oct | INTERNATIONAL TRADE REPORT | 8:30 AM |

| 5-Oct | U.S. INTERNATIONAL TRADE IN GOODS & SE… | 8:30 AM |

| 8-Oct | — COLUMBUS DAY — | — |

| 10-Oct | MONTHLY WHOLESALE TRADE: SALES… | 10:00 AM |

| 10-Oct | WHOLESALE TRADE | — |

| 10-Oct | PRODUCER PRICE INDEX REPORT | 8:30 AM |

| 11-Oct | CONSUMER PRICE INDEX REPORT | 8:30 AM |

| 15-Oct | ADVANCE MONTHLY SALES FOR RETAIL… | 8:30 AM |

| 15-Oct | MANUFACTURING & TRADE: INVENTORIES… | 10:00 AM |

| 17-Oct | NEW RESIDENTIAL CONSTRUCTION | 8:30 AM |

| 24-Oct | NEW RESIDENTIAL SALES | 10:00 AM |

| 25-Oct | ADVANCE REPORT ON DURABLE GOODS | 8:30 AM |

| 25-Oct | ADVANCE ECONOMIC INDICATORS REPORT | 8:30 AM |

| 26-Oct | GROSS DOMESTIC PRODUCT | 8:30 AM |

| 31-Oct | — HALLOWEEN — | — |

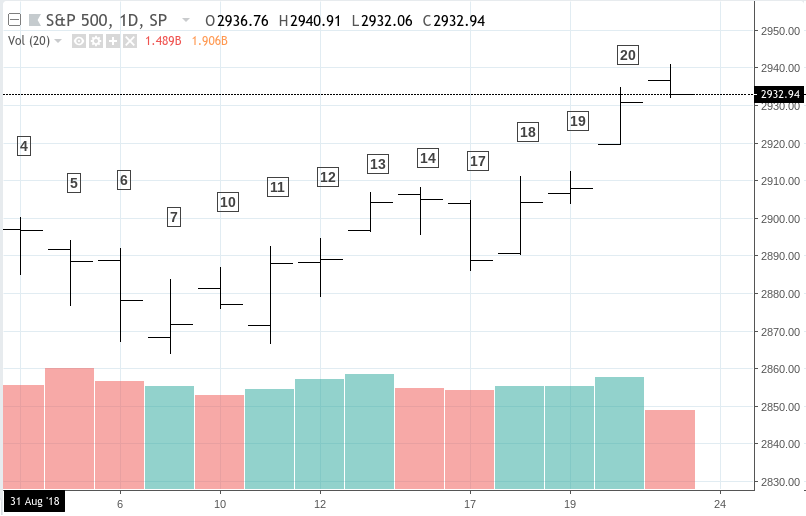

Key Events That Moved the Market in September 2018

Above: S&P 500 Daily Chart: Sep 4 to Sep 21, 2018

September 4

- US stock indices initially declined and bounced from its lows to close virtually near its open; trade concerns may have affected investor sentiment.

- August ISM, expected to be 54.5 exceeded consensus at 61.3

- August PMI at 54.7 fell within consensus range.

- Positive investors sentiment from a low global interest rate environment and strong US corporate earnings seems to be supporting US stock indices.

September 5

- Stock indices declined as fears increased that the US might escalate tariffs on China later in the week.

- Trade talks between the US and Canada are expected to take place this week.

- China’s Shanghai Composite index fell 1.7%; US markets, although lower, continue to outperform China’s.

September 6

- President Trump’s plan to impose an additional $200 billion tariff on Chinese goods may have weighed on investors.

- In response, China warned of retaliation should new tariff measures be introduced by the US.

- Jobless claims fell by 10,000, the lowest it had seen since December 1969.

- The ADP Employment Report showed an increase of 163,000 jobs in August.

- PMI report showed that growth had slowed in August to a solid 54.8 which is slightly below consensus expectations.

September 7

- Indices declined further when the Employment Situation report showed an increase in both wage growth and hiring, indicating that the Fed may continue to raise interest rates.

September 10

- US markets opened higher as hopes for a new round of tax cuts–a plan dubbed Tax Reform 2.0, to be unveiled later in the week–overshadowed trade tensions.

- July consumer credit increased above expectations to $16.6 billion.

- Chinese exports weakened to below 10% in August, down from 12% the previous month.

September 11

- Indices opened lower as concerns over US-China trade tensions continued.

- But the JOLTS report, which showed that job openings surged in August (6.939 million), and the business optimism index both exceeded expectations, potentially countering the initial selling pressure on markets.

September 12

- Markets closed relatively unchanged.

- Producer inflation in August came in below expectations as PPI declined 0.1%.

- Atlanta Fed Business Inflation Expectations came in 0.1% higher than expected at 2.2%.

- Crude inventories fell by 5.3 million barrels.

September 13

- Markets are higher after China announced that it may be holding a new round of trade talks with the US.

- Consumer prices (CPI) fell within consensus while food and energy prices came in 0.1% below expectations.

- Labor markets continued to show signs of strength as jobless claims fell to 204,000, beating expectations of 210,000.

September 14

- Retail sales increased 0.1% from August, well below economist expectations of 0.4%.

- Industrial output increased, coming in within expectations.

- US import prices decreased by 0.6%, lower than what economists had expected.

- Consumer sentiment jumped to 100.8, well above consensus expectations of 97.00

- Markets were up overall, with hopes of continued trade talks and global low interest rate environment serving as dominant factors in supporting US stock indices.

September 17

- Markets are down, primarily due to news that China might retaliate if Trump announces new tariffs on $200 billion worth of Chinese goods.

September 18

- News that the White House plans to impose a smaller levy of 10% on Chinese goods may have given rise to optimism in global markets.

- Though confidence among the nation’s homebuilders remain low, the Housing Market Index met consensus estimates of 67.

September 19

- US index market action was generally muted.

- Housing starts jumping by 9.2% to 1.282 million while building permits fell by 5.7% to 1.229 million last month.

September 20

- S&P 500 advanced to new historical highs despite the lack of any news other than the jobless claims report which was overall bullish.

- All four jobless claims readings fell to record lows and far below consensus expectations.

- Initial jobless claims fell to 201k as compared with an expected 210k; new claims were at -3,000, beating expectations of only -1,000.

September 21

- Many analysts seem to be at a loss to explain the US stock market advance in light on the ongoing geopolitical trade tensions.

- S&P 500 advanced to new highs overnight on no news.