In our previous two installments of our order flow series, we’ve covered the way order flow works and how to take advantage of the imbalances within the order flow process. In this installment, we’ll cover the other side of order flow–the more passive space of limit orders.

A limit order is simply an order to be filled at a specific price or better. If you aim to go long a position at say, 25.00, then a limit order at that price seeks to be filled at that specific price or any price below it (the lower the better). If you aim to sell or go short at 25.00, then your aim is to sell at that specific price or higher.

Simple enough, right? But anyone who has traded live knows that limit order don’t always get filled. You place a buy limit order at 25.00 and see price move below your price perhaps as low as 24.50, yet price moves back up above 25.00 without giving you a fill. Why not? What happened? The likely answer is that traders with market orders started buying higher before your order got filled.

So who got filled between 24.50 and 25.00, and why didn’t your order get filled? The likely answer is that you were not at the front end of the queue. In short, you were close to last in line to get filled. And what made the difference between you and the other trader who got filled? The answer is speed. Your order routing was probably slower than the other traders whose orders were earlier on in the queue.

The Order Queue and Why Execution Speed Makes a Difference

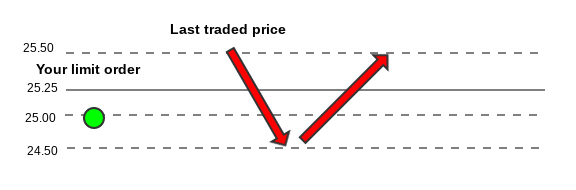

Take a look at the hypothetical price action below.

- You placed a buy limit order at 25.00

- The last traded price as at 25.50.

- Price trades all the way down to 24.50 and moves back up without giving you a fill.

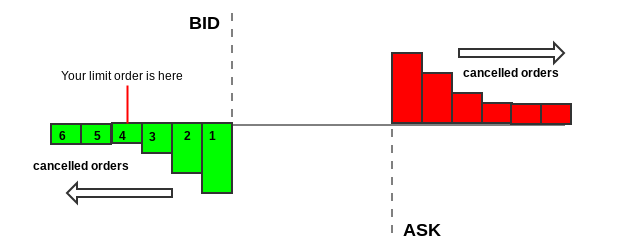

What happened? The diagram below shows a likely scenario.

- The numbered blocks on both sides shows the order priority of the queue–in other words the order that are first to last in line.

- The order from first to last are designated by numbers 1 – 6. These are all hypotheticals, but the point here is to translate the “concept” behind the mechanics of limit order flow.

- Let’s suppose that your limit order was in the segment of the queue designated #4. Your order wasn’t last in line but it certainly was anywhere near the front of the queue.

- When you noticed that price moved below your order, it’s possible that the 1st or 2nd row of order were filled, leaving orders 3 – 6 unfilled as price began trading above your limit order price of 25.00.

So why weren’t you higher up in the queue? Either your order routing was too slow, or that other traders’ order routing was just much faster. Perhaps the other traders had a lower-latency platforms, faster internet speed, more powerful computers, or even utilized co-located servers.

Low-latency isn’t a significant factor for every trading strategy. Swing traders and position traders can often get by without High Frequency Trading-like speed. But if your intention is to take advantage of order flow on a low-latency scale, then speed counts. Should you use a low-latency platform, upgrade your internet, or subscribe to co-location services? It really depends on whether your strategy depends on it. But if your trading approach does depend on speed, then not having a means to execute quickly might work against your performance.

Please be aware that the content of this blog is based upon the opinions and research of GFF Brokers and its staff and should not be treated as trade recommendations. There is a substantial risk of loss in trading futures, options and forex. Past performance is not necessarily indicative of future results.